Zeta Global: Data, Diversification, and Dilemmas

A Balanced Look at Zeta’s Strengths, Valuation, and Lingering Concerns

TL;DR

Zeta offers a diverse, data-driven MarTech platform with unique exposure to automotive, retail, and insurance sectors.

The company’s advantage stems from the industries it serves and proprietary data.

Prior deals and leadership history introduce risks, limiting conviction for a larger position.

Valuation appears reasonable if growth and execution continue.

Introduction

If a company passes my initial sniff test, I usually take a small position to justify a deeper dive. One such company is Zeta—it passed many of my criteria, so I took an initial position representing over 1% of my portfolio. Given the hype on X-finance, I had been putting off my own research for too long. Here, I walk through my concerns and the corresponding rebuttals. Surprisingly, I still hold a favorable view of the company.

Zeta’s proprietary data collection methods could be disrupted.

It’s unclear whether their data cloud offers a true competitive advantage.

The valuation isn’t especially attractive.

Zeta Global’s potential conflict of interest with Casting Made Simple Corp.

The CEO’s bankruptcy history with InPhonic.

I’ll evaluate each of these issues in this writeup to see if the bear thesis holds up.

This is not a full Zeta deep dive—if you want more background, please read

A short summary here.

Overview: Zeta Global (ZETA) is a New York–based marketing technology company, founded in 2007, that provides a cloud-based platform (ZMP) enabling enterprises to personalize customer experiences across all digital channels using AI, data integration, and identity resolution.

Conclusion: Zeta offers a compelling, integrated MarTech platform with strong execution, visible operating leverage, and exposure to favorable industry trends. Valuation appears attractive if execution continues, but

is cautious about seeing multi-bagger potential given the competition and overall upside.

Data and Zeta’s Advantage

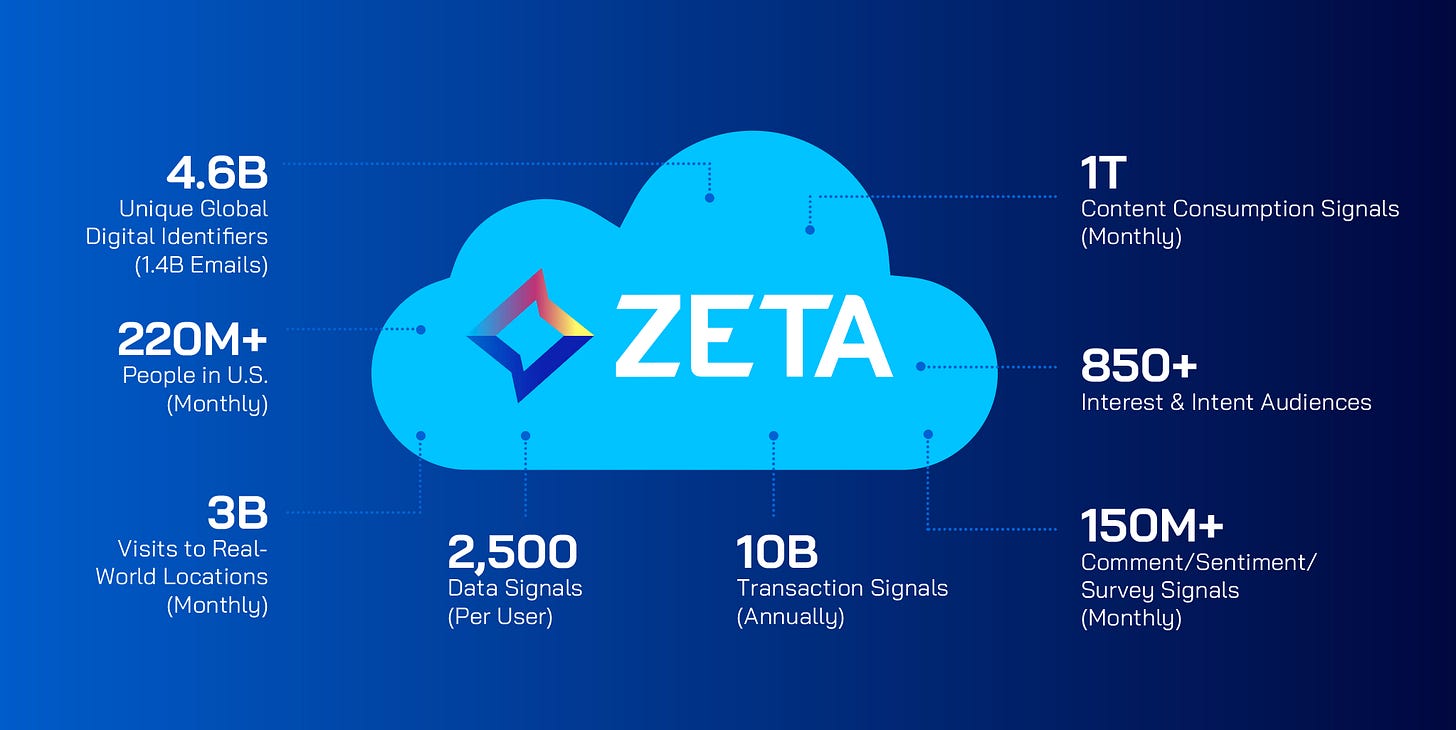

Zeta Global collects its data through a multi-faceted approach, emphasizing proprietary, consented, and first-party data to power its AI-driven marketing platform. Zeta collects data under strict, legally compliant methodologies, adhering to regulations like GDPR and CCPA. It has two main sources of permissioned data:

Digital permission from 245 million U.S. individuals who consent to tracking in exchange for online content, and

Email permission from 110 million individuals who have explicitly opted in.

As of early 2025, approximately 93.1% of the U.S. population has internet access, which equates to about 322 million individuals. So, digital permission from 245 U.S. individual is a huge amount of data and definitely a competitive advantage for Zeta.

Following a recent short-seller report, the company has committed to being more transparent about its data collection and consent practices. Zeta highlights its independence from third-party cookies as a key competitive advantage in the changing privacy landscape.

Types of Data Collected

An identity is a unique person, linked offline (like by email) and online through login or clicks. Identifiers—such as email hashes or phone numbers—help find these identities across platforms. Signals are data Zeta’s AI uses to understand consumer interests and intent.

Key Data Sources and Collection Methods

Zeta leverages a comprehensive mix of proprietary, partner, and publicly available data, further strengthened by its acquisitions. The primary method for collecting data is directly from consumers, including:

Owned platforms and newsletters: Such as ArcaMax, as well as partner sites using tools like Disqus (for data on engagements, comments, polls, etc.)

Acquisitions and partnerships: Expanding its data sources through acquisitions like LiveIntent, and partnerships with major publishers and third-party data providers (including outlets such as The New York Times and The Wall Street Journal).

Tracking technologies and proprietary platforms: Utilizing platforms like its Message Transfer Agent (MTA) for email, and programmatic ad tools (SSPs and DSPs) to gather data on user activity, ad impressions, and consumer behavior.

Credit bureau data: Zeta licenses data from credit bureaus to validate and verify its existing datasets.

Read more on Zeta data cloud here.

Major Sustainability Risks

Tightening Privacy Regulations: Stricter global privacy laws and opt-in requirements create hurdles for data collection and international scalability.

Consumer & Market Pressure: Rising consumer opt-outs and regulatory actions threaten data availability and reduce Zeta’s targeting capabilities.

Tech Ecosystem Shifts: Browser, OS, and publisher API changes can disrupt data access, demanding constant adaptation by Zeta’s tech teams.

Competitive Advantage

Integrating all these sources, Zeta builds a large, compliant data cloud that powers targeted, personalized marketing. However, this raises the question: what is the true competitive advantage of data collected from user engagements and news publishing websites? I want to understand who Zeta’s customers are that require such content—customers whose needs aren’t met by the typical “walled garden” data from search engines or social media platforms.

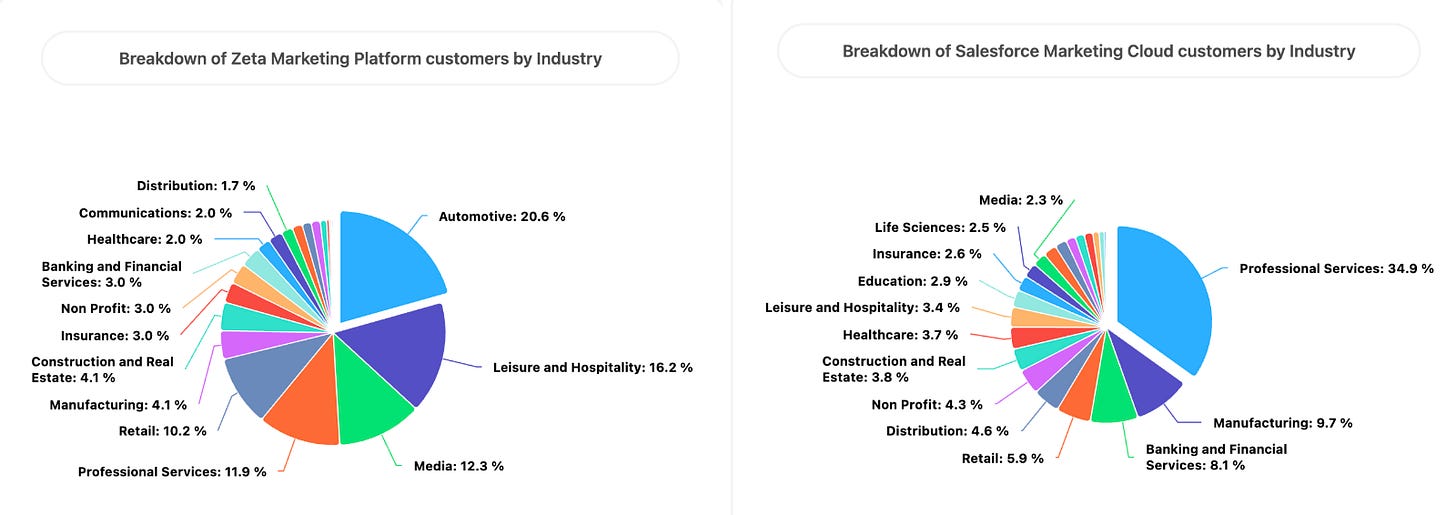

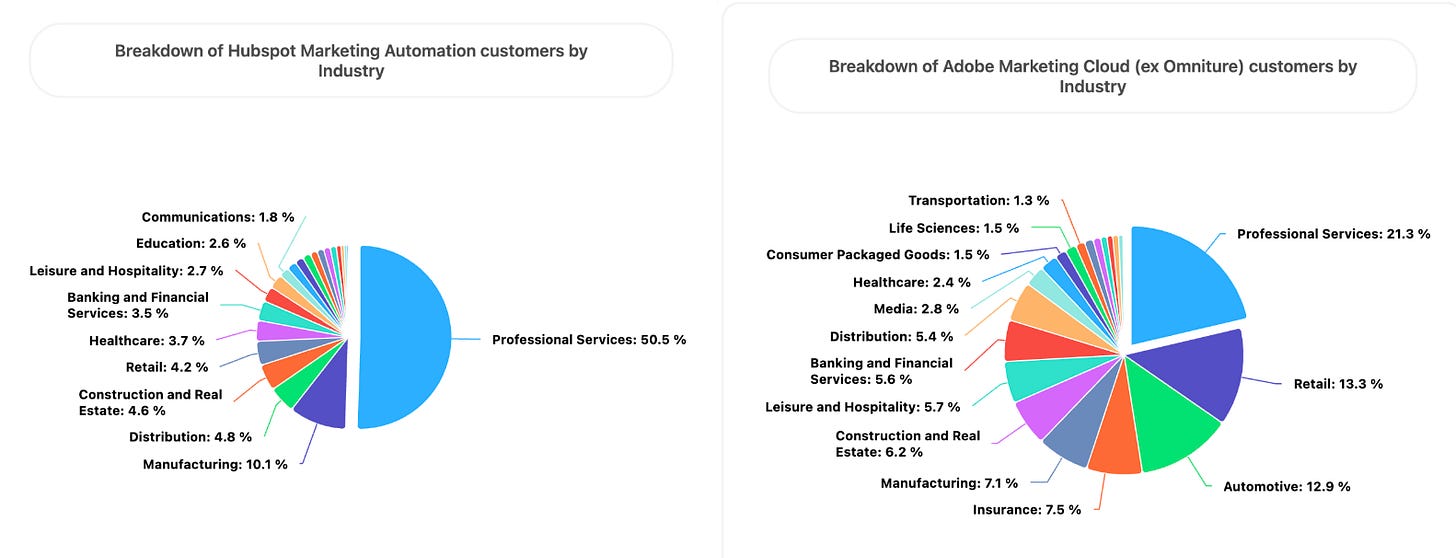

To explore this, I identified Zeta’s customers and compared them against those of Salesforce, Adobe, and Hubspot’s marketing technology platforms. Charts shown here are from https://www.appsruntheworld.com/ and reflects the count, not the revenue generated by them.

To my surprise, while all the large competitors focus on professional services, Zeta’s customer base is much more diversified, with its largest segments in the Automotive, Leisure and Hospitality, and Media sectors. Salesforce, Adobe, and Hubspot’s technology is typically used to market to professionals searching for new tools, such as developers platforms or security softwares—think AWS, CrowdStrike, or GitLab reaching their enterprise customers. The dynamics for Zeta, however, are quite different.

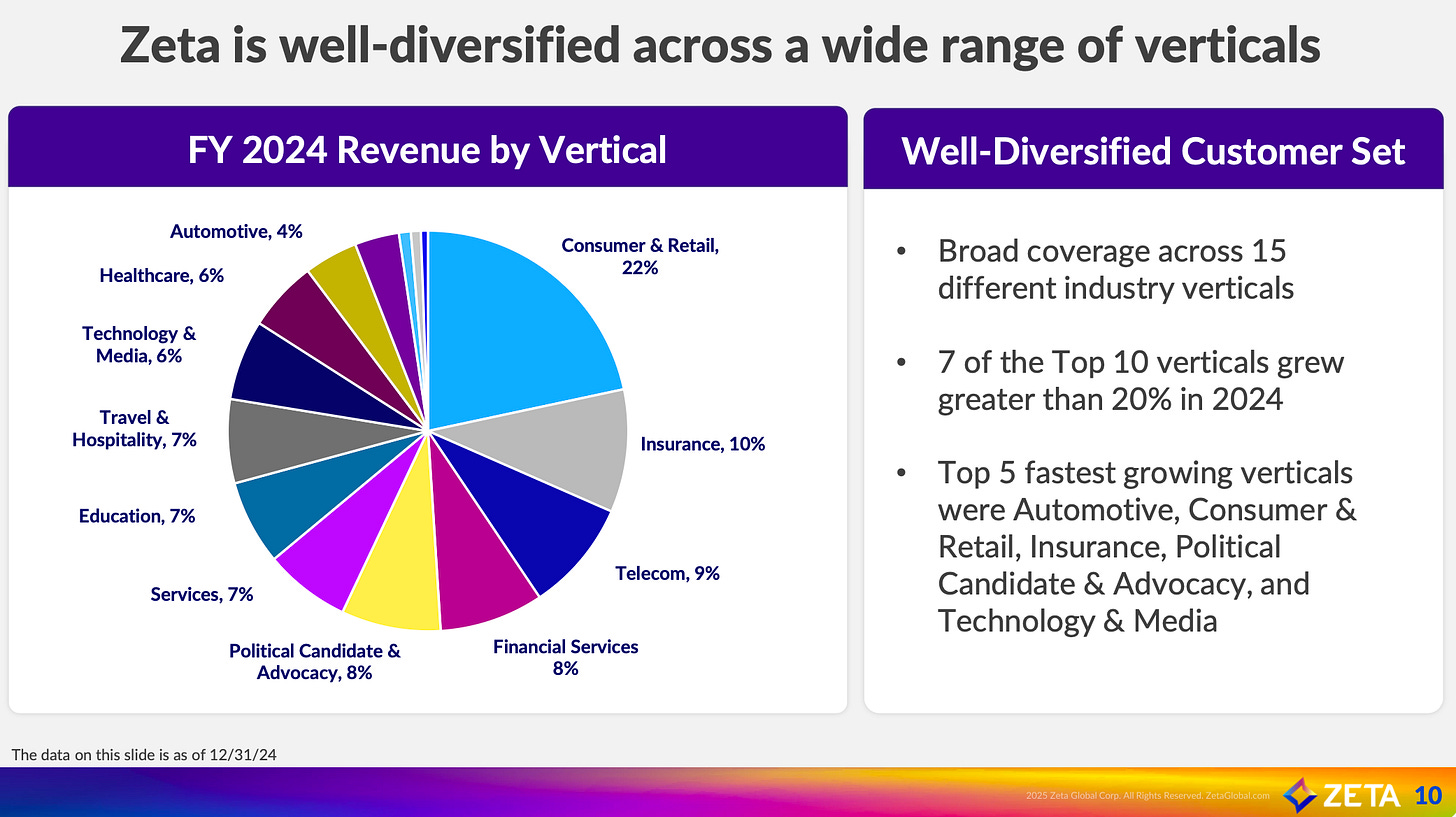

Zeta’s graph data contains signals that connect users with multiple intents. The company ingests over one trillion content consumption signals per month globally, synthesizing these into hundreds of intent-based audiences. This data is strategically used for marketing in industries that rely more on advertising than traditional marketing. ZMP is utilized by major clients like T-Mobile (telecom), Dollar General (retail), and New York Life (insurance). Zeta also targets high-volume auto retailers—typically national or regional dealership chains—who leverage AI, personalization, and marketing automation for customer acquisition and retention.

Zeta’s revenue by sectors corroborates the customer data shown before. Marketers on Zeta need to spend continuously due to the nature of their business (consumer & retail, insurance, telecom, being top three). These customers are different than that of Saleforce, which likely have the most comparable data cloud, and has developed vertical-specific data models for financial services, healthcare, retail, where advertisers will spend more. Services being just a 7% of the revenue, gives me thinking that Zeta is at a different industry than all other large MarTech competitors. Moreover, automotive (most sensitive to interest rate cycle) being the fastest growing vertical, confirms that the customer bases data shown before is an excellent representation of which markets they are penetrating.

ZMP depends on first-party data that reveals customers’ intent to make primarily one-time purchases, such as buying a new car or phone. This also explains why Zeta obtains data licenses from credit bureaus. Ultimately, ZMP’s data advantage doesn’t stem solely from having first-party data, but rather from the unique nature of the industries where that data is leveraged for marketing. Moreover, in my opinion, sectors they are penetrating the most such as the Automotive and Leisure and Hospitality, stand to benefit significantly from falling interest rates.

Valuation

Zeta’s 2028 projection is over $2.1 billion in annual revenue and 16% FCF margin by 2028. A 20x FCF multiple gives a 6.7B market cap. That’s barely a 14% CAGR. I didn’t even consider all the dilution that continues. After I posted this in the X Zeta Investors community, I received some encouraging feedback suggesting that my assumptions are more of a bear case than a base case.

My conversation with $ZETA bulls

Counterarguments from Bulls

Several users pushed back, highlighting why Zeta might deserve a higher valuation and why the projections could be conservative.

Growth and Margin Expansion Deserve Premium Multiples: Investingperiodization (@jhinvest11) argues that a company growing revenue at 20% annually while expanding margins should trade at well above 20x FCF.

History of Beating Guidance: Serge (@Sergeant991) points out Zeta's consistent track record of exceeding its own guidance, implying that the 2028 targets are likely conservative and will be surpassed. He also views the current 32x FCF multiple as undervalued given the company's high growth trajectory.

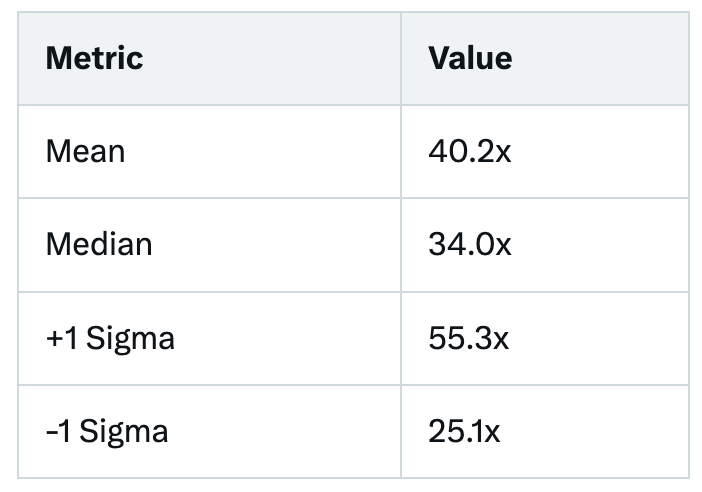

I responded by noting that Zeta's historical average multiple is under 22x, with 20x as a baseline, 15x bearish, and 25x bullish. I added that while beats have occurred (largest at 7.2%), they are narrowing (latest at 3.9%), and my analysis already assumes the targets are met by mid-2028.

Historical Valuation Data: Alamo Investing (@AlamoInvesting) provides a detailed rebuttal with statistical insights into Zeta's trading history for Price/FCF on a last twelve months (LTM) basis:

This data suggests that 20x is significantly below historical norms, positioning my valuation as overly conservative. Alamo implies this is one of several flaws in the bearish thesis.

I agree that my assumptions were conservative. Moreover, after studying the type of data Zeta collects, I believe that 2028—being an election year—will almost certainly expand the use cases for their Data Cloud and likely justify a higher multiple. So, factoring in the potential to beat expectations, a 30x multiple seems reasonable for a bull case. With a 5% share dilution (they started buying back in most recent quarter, so I can be wrong), a more than 100% return in 3 years is not hard to pencil out.

Conflict of Interest

On December 28, 2018, Zeta Global entered into an agreement with Casting Made Simple Corp. ("CMS"). CMS is an entity owned by the Caivis Group, in which Zeta's Co-Founder and Chief Executive Officer (David A. Steinberg) owns a controlling interest, and it is also owned by the CEO's spouse. It is a classic example of a related-party transaction and raises potential conflict of interest concerns.

The agreement was established to monetize traffic generated through websites owned by CMS and to share profits with CMS. The profit shared by Zeta with CMS was recognized as a direct cost of revenues.

The contract with CMS was terminated on June 30, 2024, and outstanding payables were fully paid subsequent to that date. The Company does not have an outstanding balance payable to CMS as of December 31, 2024.

I do not like this transaction but luckily it’s now terminated and I am less worried about it.

CEO’s Past History

David Steinberg has founded or led at least seven companies, including Zeta Global, InPhonic, and Sterling Cellular, with several successful exits, unicorns, and public listings.

He was named in a class-action lawsuit alleging he knowingly and recklessly signed off on inflated financial results, improper revenue recognition, and weak internal controls.

InPhonic's senior executives, including those directly reporting to CEO David A. Steinberg, orchestrated agreements with APC to receive nearly $10 million in fake credits for items such as rebates and volume discounts.

InPhonic filed for bankruptcy largely due to a combination of financial mismanagement, mounting debts, accounting irregularities, and declining revenues.

This, combined with the 2018 transaction with CMS, is why I don’t see Zeta becoming a large position in my portfolio.

Conclusion

Zeta presents an intriguing case in the MarTech landscape, with a diversified customer base, robust data infrastructure, and exposure to sectors poised for growth. While the company’s platform and data strategy offer certain competitive advantages, concerns remain regarding leadership history and related-party transactions. For now, Zeta definitely stands out as a high-quality company that is worth at least a small position in my portfolio.

The Content is not, and should not be construed as, investment advice, financial advice, or a recommendation to buy, sell, or hold any security or other financial instrument. We do not provide personalized financial planning or investment services. Always consult with a qualified financial professional before making any investment decisions. Reliance on any information provided by PennyInsight is solely at your own risk.

Great post, Penny!

Great analysis and interesting company 👍