The 4% Rule Still Works — If You Outperform Just a Little

Backtesting the 4% Rule: Outperformance vs. Lower Spending in Retirement

The FIRE (Financial Independence, Retire Early) movement is built on one deceptively simple idea: the 4% rule. If you can save 25 times your annual expenses, you can retire and withdraw 4% per year — theoretically forever. Live off your investments, let compounding do the rest, and never work another day.

It’s an elegant concept with enormous implications. But how reliable is it? And what if the market doesn’t cooperate?

In this post, we’ll walk through the logic of the 4% rule, look at when it fails, and explore a less-discussed strategy: what if you simply outperform the market by a small margin — say 1% or 2%? As we’ll see, that tiny edge could be enough to save your retirement.

Understanding the 4% Rule

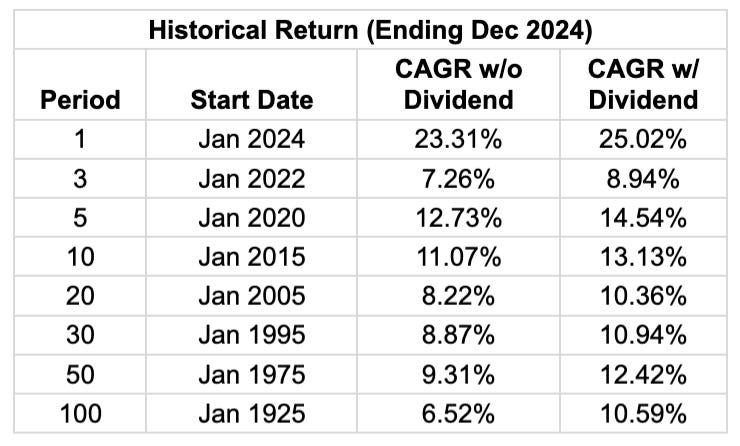

The 4% rule suggests that in retirement, you can safely withdraw 4% of your starting portfolio each year, adjusted for inflation. It assumes a balanced portfolio — typically modeled after the S&P 500 — with long-term returns historically hovering around 10% Compound Annual Growth Rate (CAGR) over the past century (including dividends).

Inflation, on average, has been around 2.6% over the past 25 years. Looking at the history of 100 years above, if we conservatively assume future nominal returns of 9%, and inflation holds steady at 2.6%, your real return is approximately 6.4%. That’s the math backing the 4% rule: returns outpace withdrawals, and the portfolio survives — even grows — indefinitely.

Simulating the Ideal Scenario

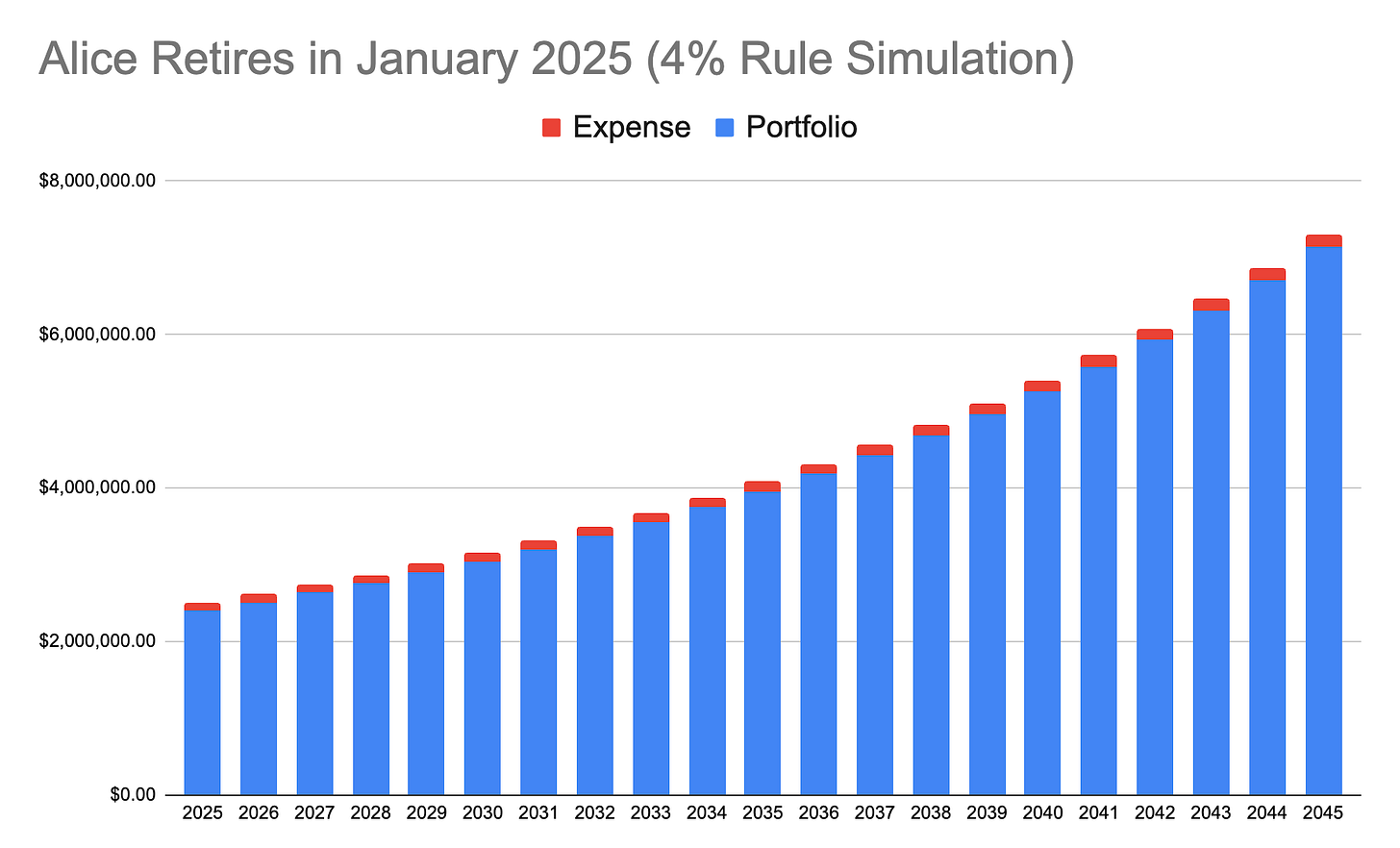

Say Alice retires in January 2025 with a $2.5 million portfolio and begins withdrawing $100,000 per year — a 4% withdrawal rate. Her portfolio earns 9% annually, and her expenses increase at 2.6% inflation.

After her first withdrawal, the portfolio drops to $2.4M, but it grows faster than her expenses. Within 20 years, Alice’s portfolio exceeds $7 million, while her expenses rise to $167K. By year 50 — in 2075 — her annual spending reaches $361K, and her portfolio is worth over $65 million.

When investment growth consistently outpaces inflation, the 4% rule doesn’t just survive — it thrives. Withdrawals become a smaller fraction of an expanding portfolio.

The math is elegant. The outcome? Financial freedom.

When the 4% Rule Fails

Of course, real life doesn’t follow a spreadsheet. Markets crash. Inflation spikes. And timing matters — especially in the early years of retirement.

Using Robert Shiller’s historical U.S. stock data (dating back to 1871), I simulated retirement outcomes across different starting years.

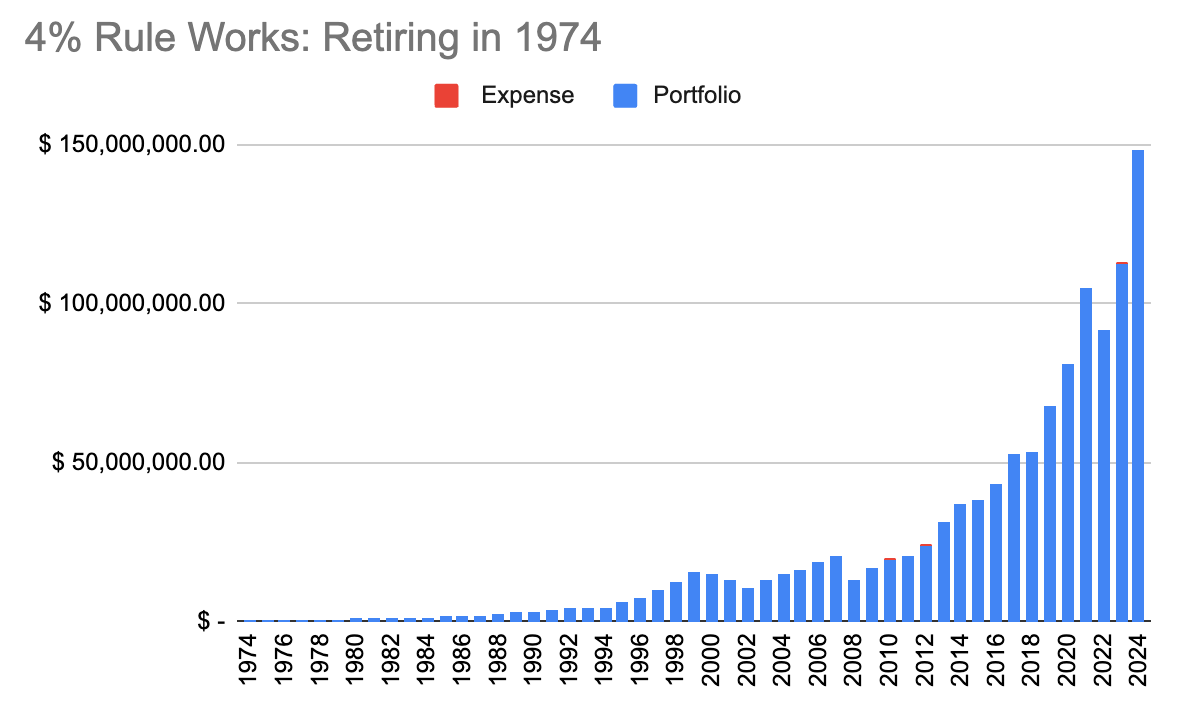

If you retired in December 1974, you’d be fine. Your portfolio would last 50 years, even with inflation and moderate drawdowns.

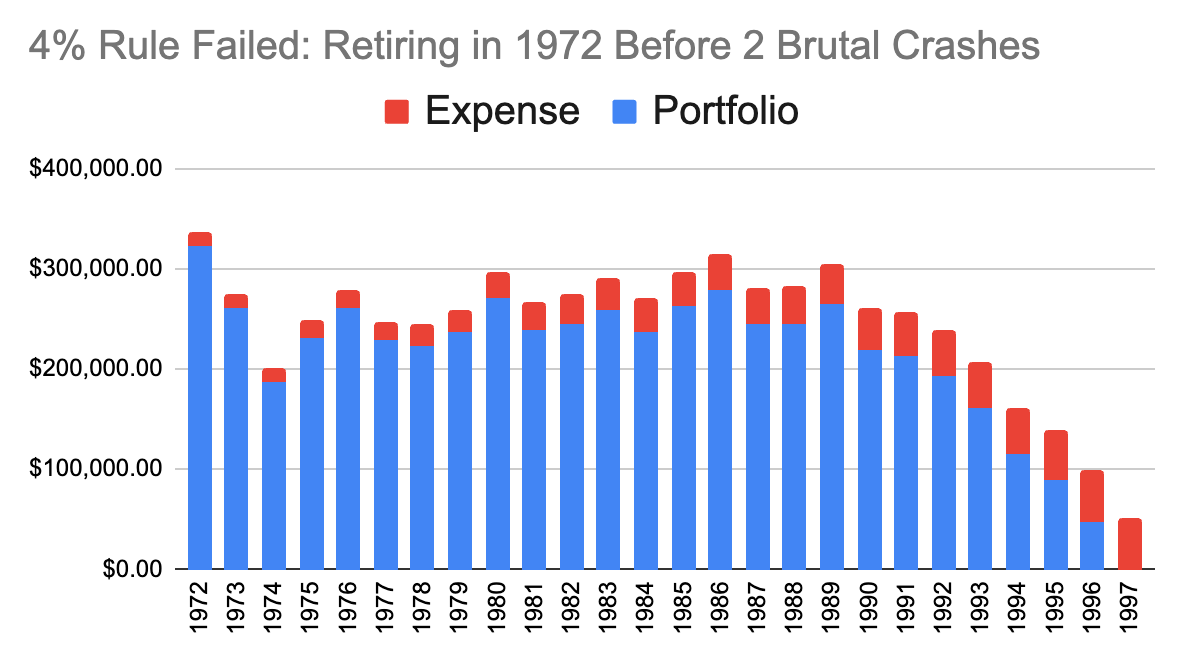

But retire just two years earlier — in 1972 — and your money runs out by 1997.

Why? The 1973–74 bear market hit just as you started withdrawing. Combine that with inflation, and your early withdrawals cripple long-term compounding. The portfolio never recovers.

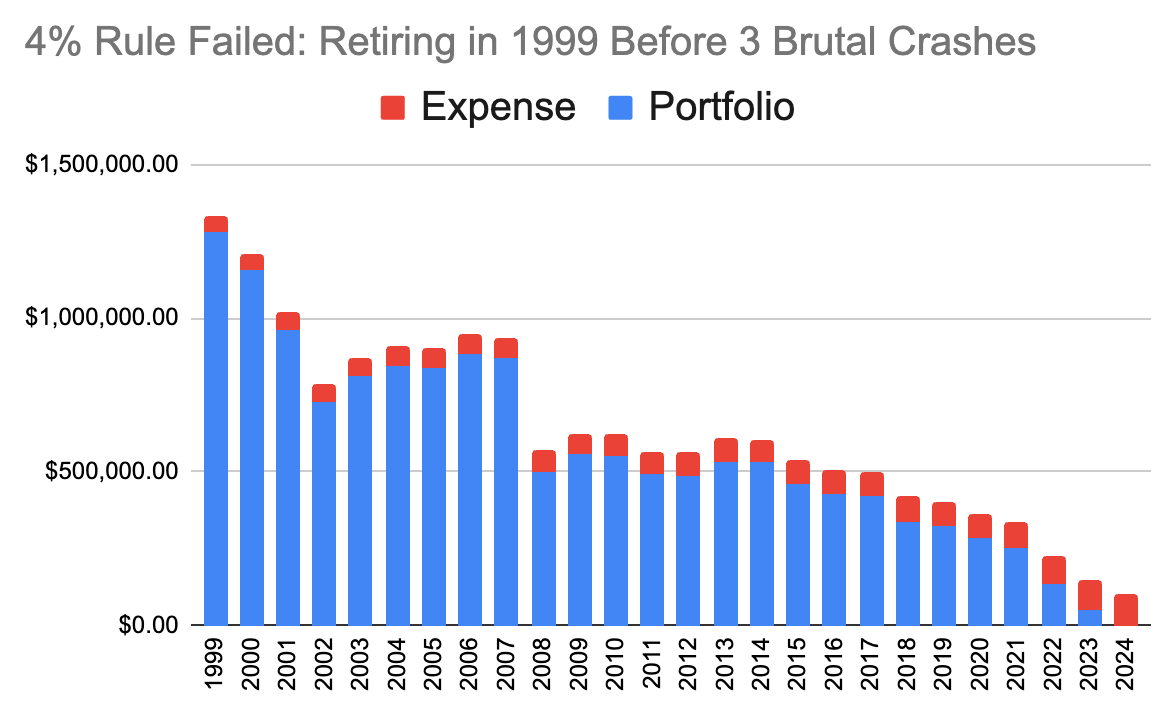

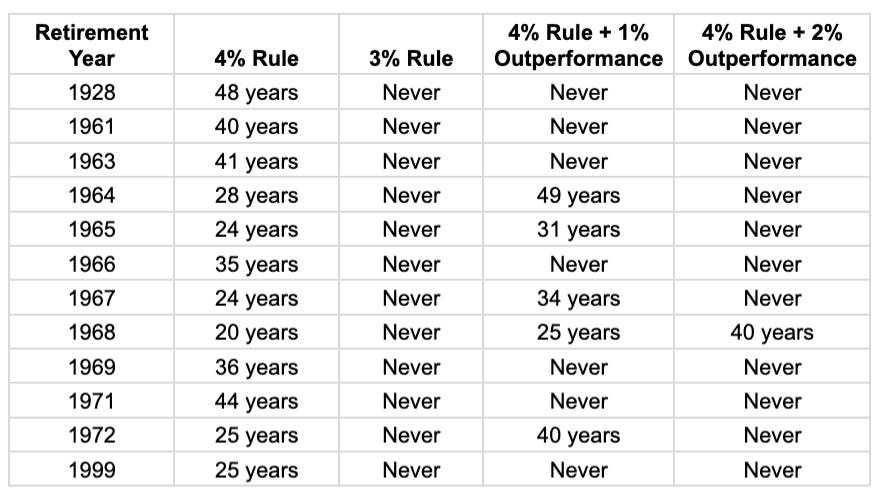

This isn’t an isolated case. In the past 100 years, the 4% rule has failed in 12 starting years that didn’t survive 50 years. 1999 is another example — retiring then would leave you broke by 2024.

So while the 4% rule works in many scenarios, it’s far from foolproof. It’s particularly vulnerable when poor returns strike early.

Playing It Safer: 3%, 2%, or Even 1%

To address this risk, many in the FIRE community adopt more conservative rules:

3% rule → Save 33× your annual expenses

2% rule → Save 50×

1% rule → Save 100×

Historically, the 3% rule has never failed — even in the worst cases like 1968 or 1999. The lower the withdrawal rate, the greater the margin of safety. Going even more conservative improves your odds of success, but it also raises the bar for how much you need to save.

A Modest Outperformance

Here’s the angle most people miss: what if you don’t change your withdrawal rate — you just beat the market slightly?

Let’s say you stick with the 4% rule but aim to outperform the market by just 1% annually. Based on my backtesting, the number of failure years drops significantly — from 12 to just 5.

Outperform by 2%? Then the 4% rule only fails in one scenario (and even then, not until year 40). In every other case, the portfolio survives.

That small edge can come from many places:

Thoughtful asset allocation

Investing in high-quality compounders

Staying disciplined during volatility

Avoiding emotional decisions

Tax optimization or fee reduction

Or simply not making costly mistakes

Even modest outperformance, compounded over decades, can overcome inflation shocks, recessions, and bad timing. It’s not easy. But it’s not impossible — especially for long-term, independent investors who control their own behavior.

The Takeaway

The 4% rule is a useful benchmark — but not a guarantee. It works in many historical periods, but it can fail when early retirement collides with market crashes or inflation spikes.

If you're risk-averse, consider lowering your withdrawal rate to 3% or less. But if you believe in your ability to invest better — even slightly — a small edge may be all you need to make the 4% rule work for you.

After five years of deep learning, modeling, and hands-on investing, that’s where I’ve landed:

The real power isn’t just in saving more or spending less — it’s in investing better.