PROCEPT BioRobotics

A High-Growth Leader in BPH Treatment Facing Headwinds on the Road to Profitability

TL;DR:

PROCEPT BioRobotics leads in urologic robotics with Aquablation, addressing BPH and entering prostate cancer trials.

Aquablation outperforms TURP on safety, side effects, and now has broad insurance coverage.

Revenue surged (Q2 2025: +48%), but profitability remains elusive.

Growth drivers include expanded coverage, HYDROS launch, and global reach; risks are tariffs, CEO change, and competition.

Stock outlook is cautious: slowing system growth, lowered guidance, and no near-term catalysts until late 2027.

Introduction

PROCEPT BioRobotics Corporation (Nasdaq-PRCT) is a surgical robotics company dedicated to advancing patient care in urology. Their core mission is to develop transformative solutions, with an initial focus on treating Benign Prostatic Hyperplasia (BPH) and a growing initiative in prostate cancer. The company strives to become the global leader in urology by providing effective, safe, and durable outcomes through their proprietary Aquablation therapy.

Benign Prostatic Hyperplasia (BPH)

BPH is the most common prostate disease, impacting approximately 40 million men in the U.S. Prevalence increases with age, affecting about 1 in 2 men aged 51-60. Symptoms significantly impact quality of life for 99% of men with BPH. The condition is characterized by an overgrowth of the transition zone of the prostate, leading to lower urinary tract symptoms (LUTS).

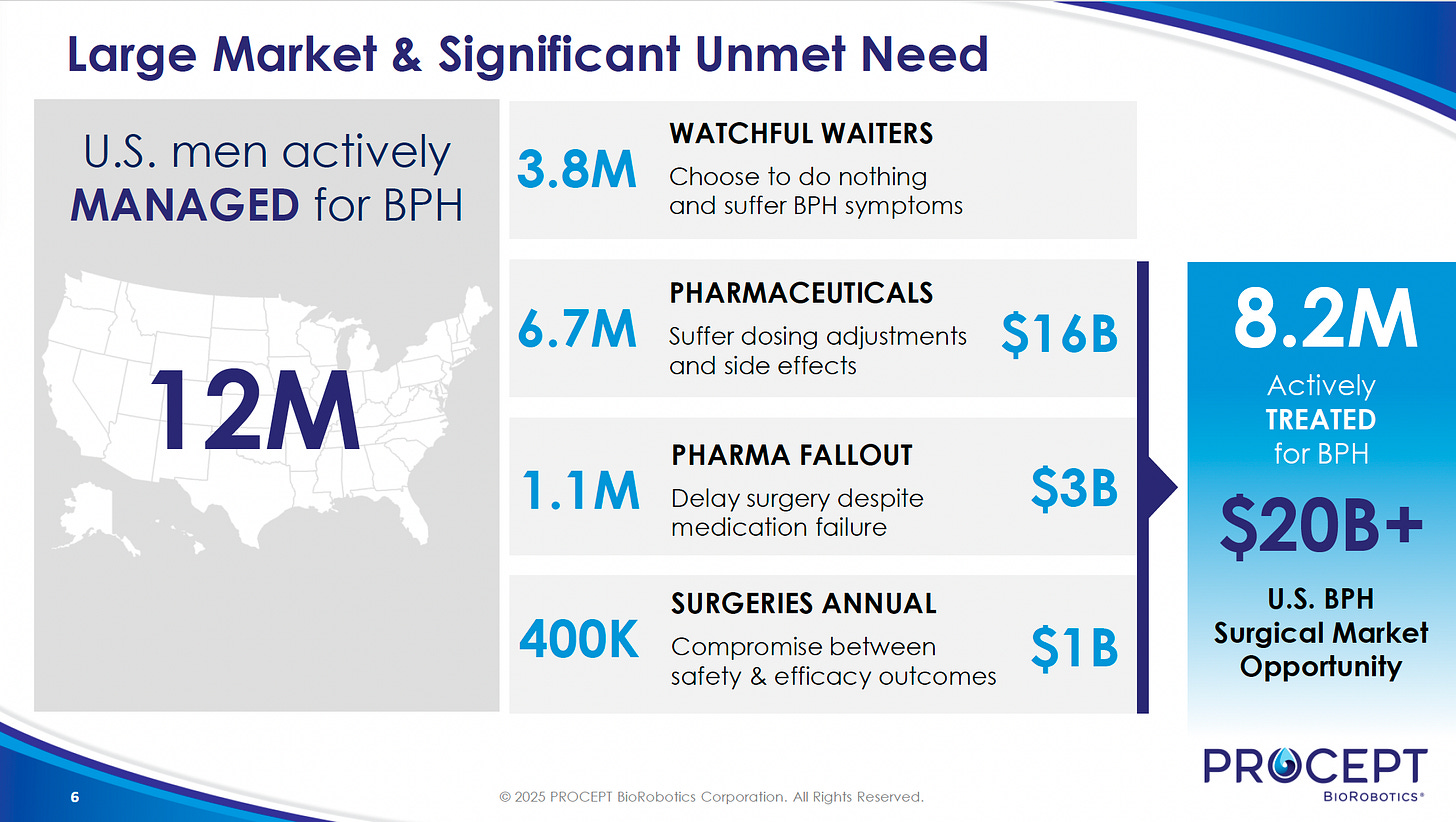

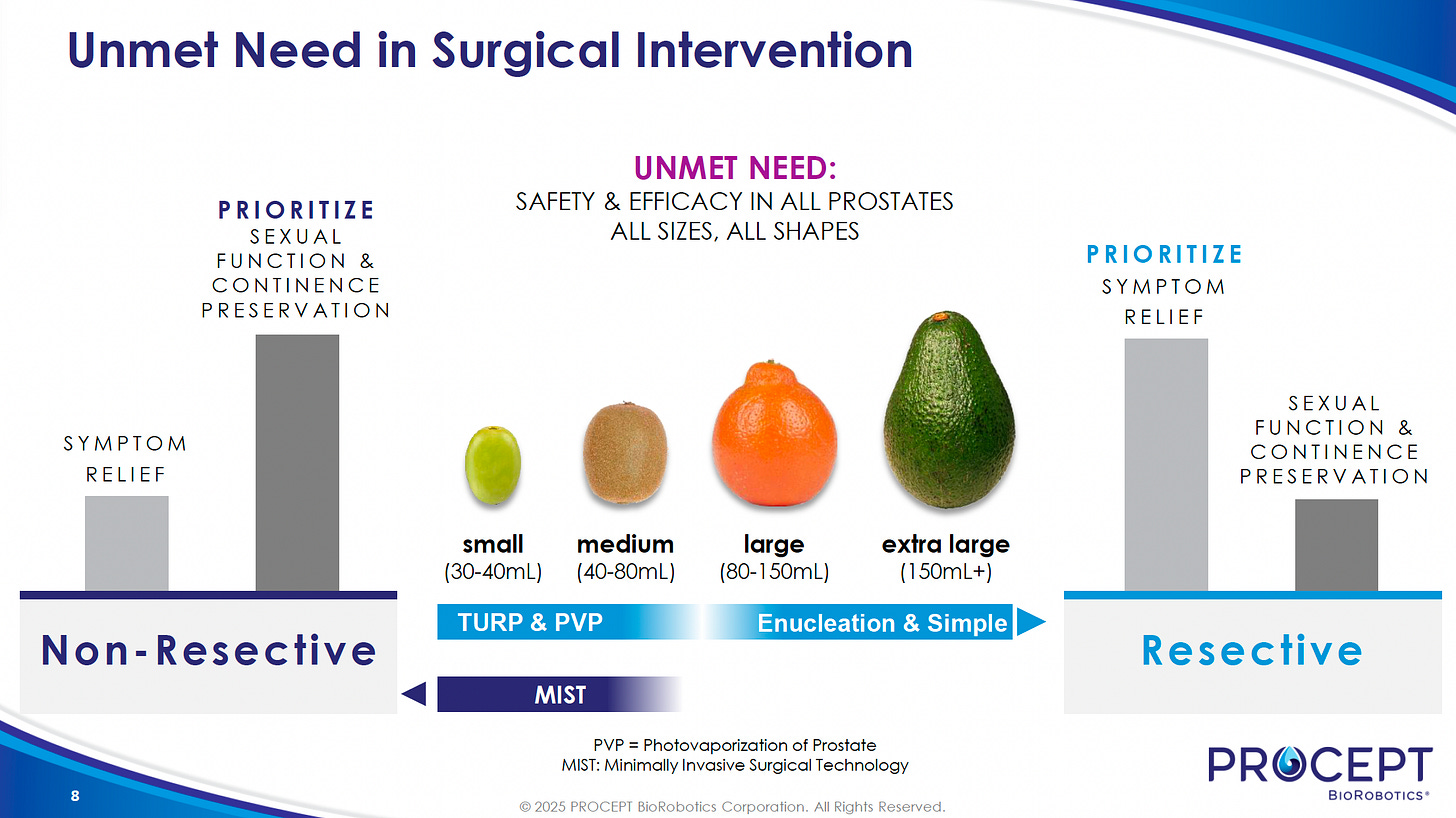

The U.S. BPH market is sizable, with 12 million men under active management and 3.8 million enduring symptoms through “watchful waiting.” Medical therapies often provide only temporary relief and poor compliance, while traditional surgeries are effective but carry the risk of significant, irreversible side effects. Approximately 400K surgical interventions for BPH are performed annually in the United States. Of these, an estimated 290K are resective (surgical removal of problematic tissue) procedures performed across roughly 2,700 hospitals. With an estimated $20 billion market, there's a clear need for safer, highly effective options. Aquablation therapy aims to bridge this gap by combining strong efficacy with a better safety profile.

Aquablation Therapy

Aquablation therapy, developed by PROCEPT BioRobotics, is a surgical robotic procedure that treats BPH and its urinary symptoms, and is now being trialed for localized prostate cancer.

Mechanism: A robotically controlled waterjet removes prostate tissue without heat, minimizing damage to nerves critical for continence and sexual function.

Systems: Delivered via the image-guided AquaBeam® and next-gen HYDROS™ robotic systems (the latter features AI-powered planning), ensuring accurate and consistent results regardless of surgeon experience.

Imaging: Combines real-time ultrasound and cystoscopic views (internal images of the bladder and urethra) with software that lets surgeons personalize and monitor treatment contours during surgery.

Efficacy: Proven to be safe and effective for BPH across all prostate sizes—clinical trials (WATER, WATER II/III) show outcomes equal or superior to TURP (gold-standard surgical treatment), with very low rates of lasting complications or side effects.

Clinical Evidence for Aquablation

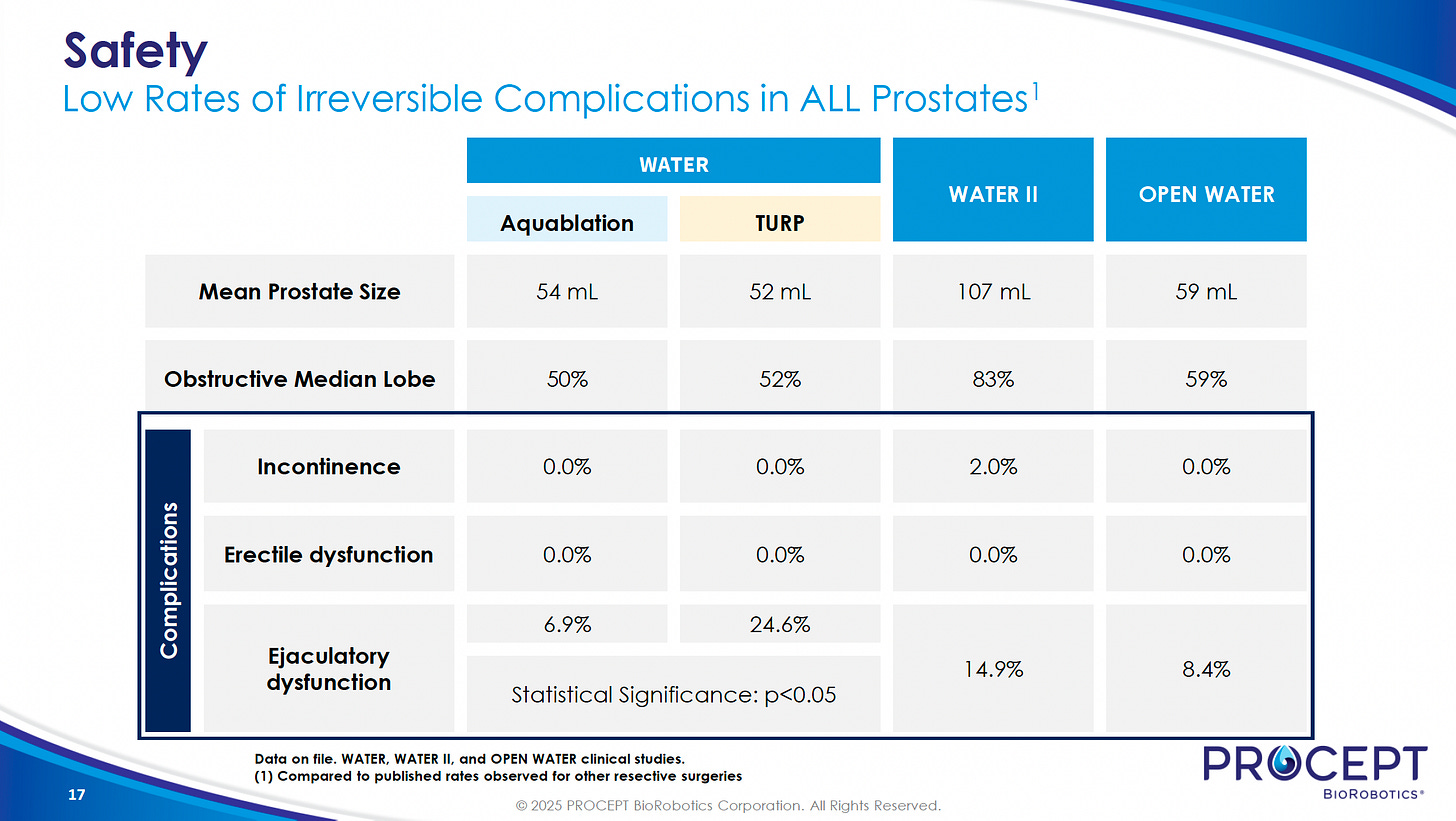

The pivotal U.S. WATER trial found Aquablation safer than TURP, with comparable results for prostates 30-80ml and even greater efficacy for those over 50ml. In this study, ejaculatory dysfunction occurred in 6.9% of patients who received Aquablation therapy, compared to 24.6% of those treated with TURP.

WATER II and OPEN WATER studies demonstrated that Aquablation provides sustained, long-term results, with incontinence (accidental urine leakage) occurring in no more than 2% of patients.

Backed by around 150 peer-reviewed publications, Aquablation is now included in leading clinical guidelines such as those of the American Urological Association (AUA).

Coverage and Pricing

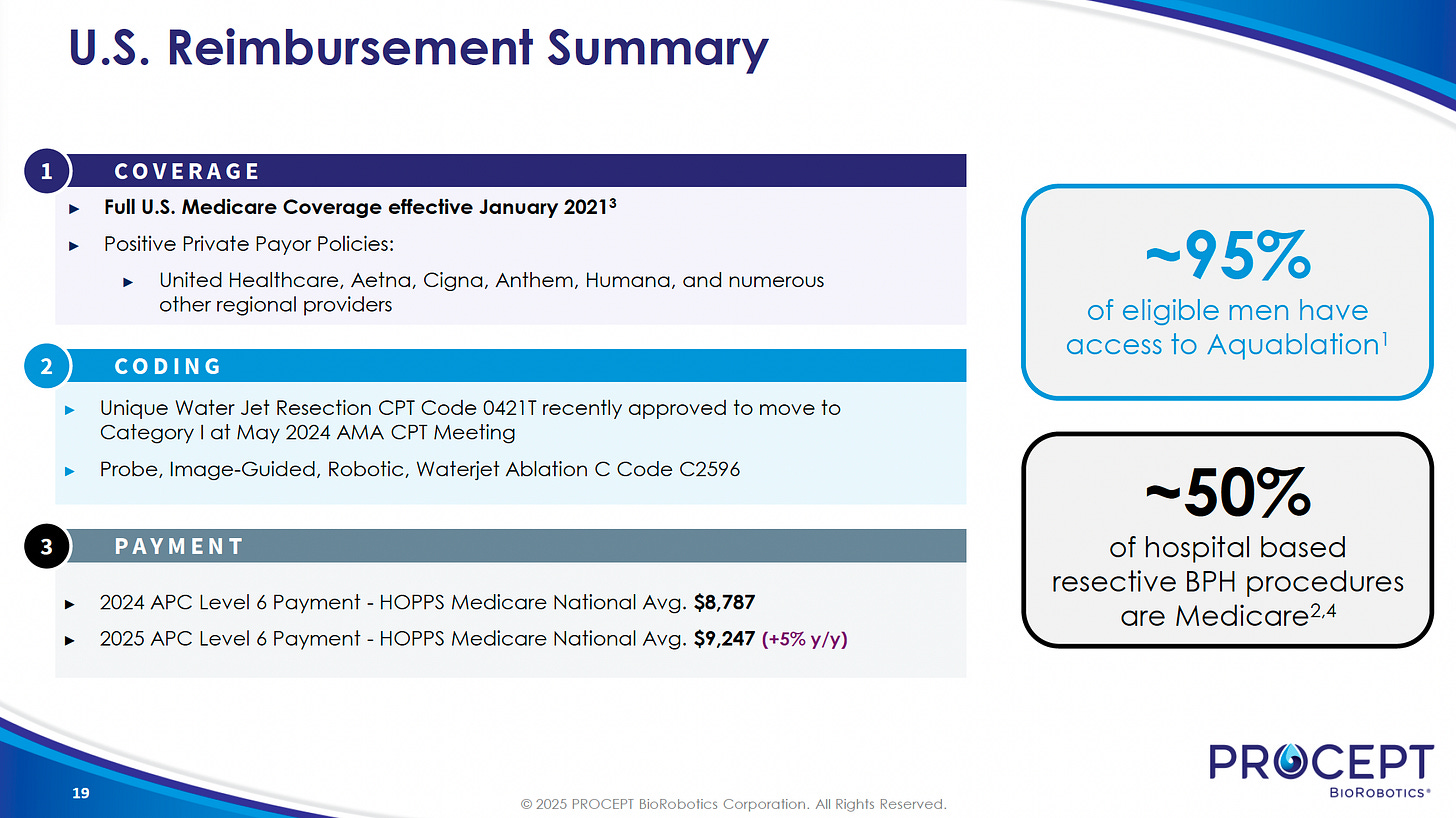

Medicare: Full nationwide coverage—including Medicare Advantage—since January 2021. Covers about 50% of all U.S. hospital-based BPH procedures.

Medicare RAC Audits: Limit BPH reimbursement to cases with prostate size ≤150 grams; impact is minor, as only 25% of the market is audited, and <10% of cases exceed this size.

Major commercial payers (United Healthcare, Aetna, Cigna, Anthem, Humana) provide coverage, giving about 95% of eligible U.S. men access to Aquablation.

Humana is the only major private insurer with a 150g prostate size cap for coverage.

PROCEPT is working with payers and surgeons to further reduce or eliminate size-based restrictions.

Other BPH Treatments

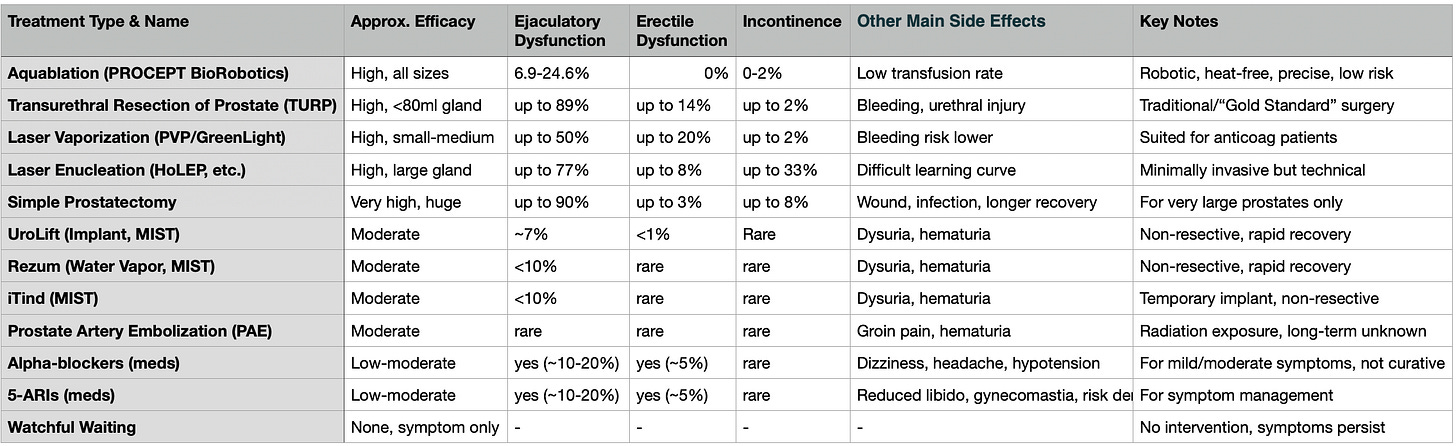

Resective Surgeries:

TURP (Transurethral Resection of the Prostate): Gold standard for <80ml prostates; uses electrocautery to cut/remove tissue.

Laser Enucleation of the Prostate (PVP, HoLEP, etc.): Vaporize or resect tissue, often for larger prostates; require advanced skill.

Simple Prostatectomy: Invasive, reserved for very large prostates or severe cases.

Non-Resective/MIST Options:

UroLift, Rezum, iTind: Reshape the urethra without tissue removal; less durable results; best for small-to-average prostates.

Pharmaceuticals:

Alpha-blockers, 5-ARIs: Ease symptoms or shrink prostate, but most need ongoing treatment.

Other:

Prostate Artery Embolization (PAE): Similar efficacy to non-resective methods, in use for 25+ years.

Watchful Waiting: No active treatment; symptoms persist.

TURP vs Aquablation Therapy

TURP is often chosen over Aquablation due to reputation, access, cost, insurance coverage, and provider familiarity—even though Aquablation offers potential advantages in side effect reduction.

TURP is typically less expensive and more likely to be fully covered by insurance or national health systems, whereas Aquablation may be costlier and sometimes not covered, especially where it is newer.

For smaller prostates, the advantages of Aquablation are less pronounced, so TURP may be preferred for simplicity, familiarity, and reliable results in these cases. TURP is also well-established for immediate symptom relief in a wide variety of BPH patients.

TURP is far more widely available in hospitals and clinics than Aquablation. Not all centers offer Aquablation, and in many regions, TURP remains the primary surgical option for BPH (benign prostatic hyperplasia).

Some patients and doctors prefer traditional surgery—a known quantity with clear expectations. Others may have concerns about new robotic or hydro-based methods or simply opt for the more familiar approach.

Growing Interest of Aquablation Therapy

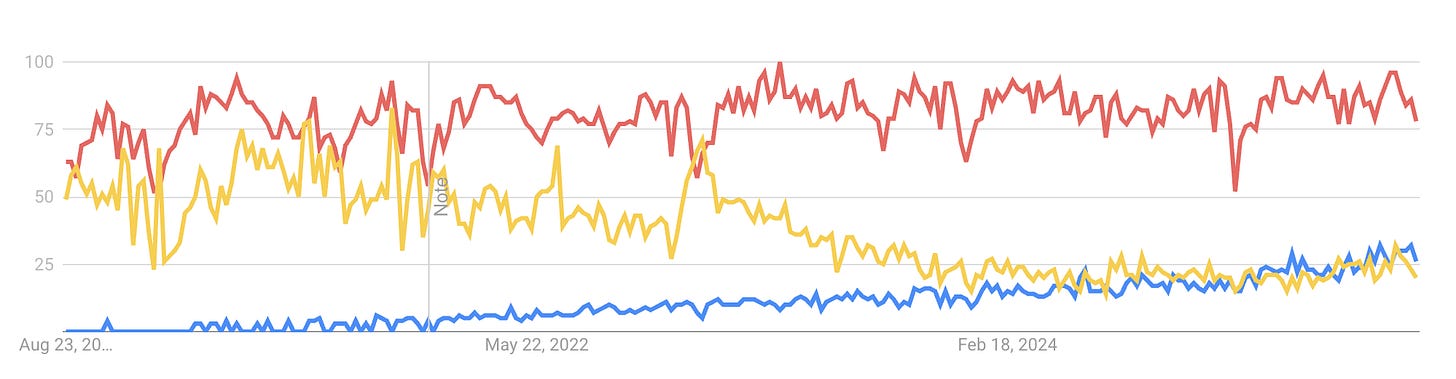

Based on Google Trends data, Aquablation (blue line) continues to show consistent growth in search interest, indicating rising awareness and curiosity among both patients and providers. Meanwhile, TURP (red line) remains stable in popularity, maintaining its position as a well-established standard of care. In contrast, alternative procedures that have lower efficacy and fewer side effects—such as UroLift (yellow line)—are experiencing a decline in search interest, suggesting waning public and clinical enthusiasm.

Product and Technology

AquaBeam Robotic System

The AquaBeam Robotic System is PROCEPT BioRobotics' advanced, image-guided, surgical robotic system for minimally invasive urologic surgery. Its proprietary Aquablation therapy combines:

Real-time, multi-dimensional imaging (transrectal ultrasound imaging).

Personalized treatment planning.

Automated robotics.

Heat-free waterjet ablation for targeted and rapid removal of prostate tissue.

Aquablation therapy is designed to deliver consistent, reproducible outcomes independent of prostate size, shape, or surgeon experience. It minimizes variables that impact outcomes with a precisely calibrated, heat-free waterjet, avoiding thermal injury associated with heat-based options.

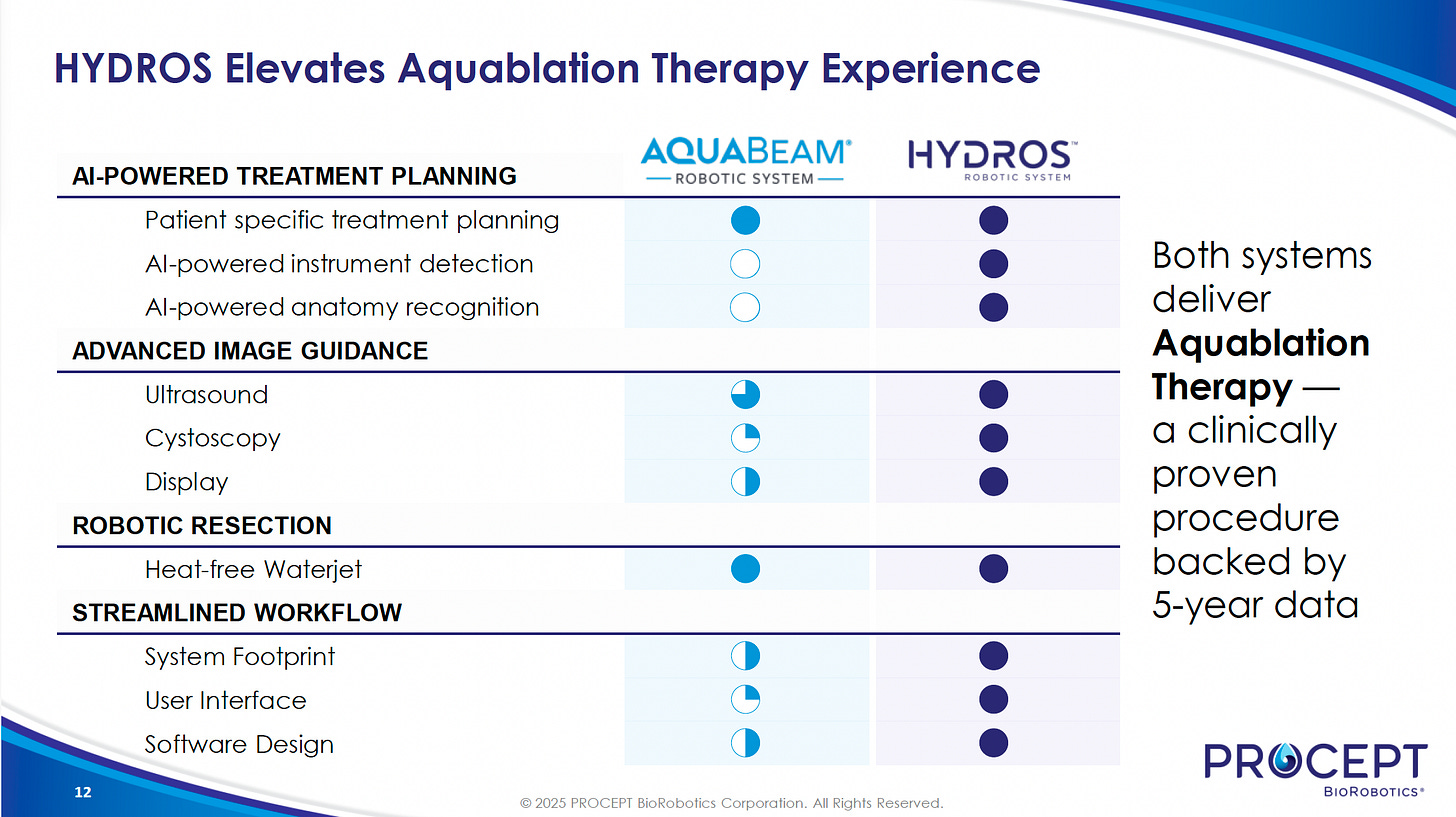

HYDROS Robotic System

The HYDROS Robotic System is the next-generation platform for Aquablation therapy, launched in 2024. Key advancements include:

AI Treatment Planning (FirstAssist AI): Algorithms guide the surgeon for accurate planning.

Advanced Imaging: Enhanced imaging capabilities form the foundation of the system's success.

Streamlined Workflow: Improved user interface, integrated tower, and single-use digital cystoscope simplify setup, procedural workflow, and operating room turnover, reducing the need for scope reprocessing.

Single-use Digital Cystoscope: Eliminates the need for scope sterilization, saving hospitals time and money.

Integrated Design: Offers a single footprint, making it more efficient and user-friendly for hospital staff and surgeons.

Revenue Model

PROCEPT generates revenue primarily through the sales and rentals of its robotic systems, the sales of single-use disposable handpieces and other consumables, and service and repair contracts.

Robotic Systems Sales and Rentals: The company develops, manufactures, and sells the AquaBeam Robotic System and the next-generation HYDROS Robotic System. These are advanced, image-guided, surgical robotic systems used in minimally invasive urologic surgery, primarily for treating BPH. They also engage in sales-type lease arrangements for robotic systems, and these leases typically have a term of 48 months.

Approximately 45% of U.S. system placements in Q1 2025 came from corporate Integrated Delivery Network (IDN) multi-unit orders.

Average selling prices for robotic systems are trending higher, with greenfield system pricing at approximately $455,000 in Q2 2025.

Useful life of its robotic systems somewhere in the 5 to 7-year range.

Single-Use Disposable Handpieces and Other Consumables: Each robotic system employs a single-use disposable handpiece to deliver Aquablation therapy. This represents a recurring revenue model alongside post-warranty service contracts.

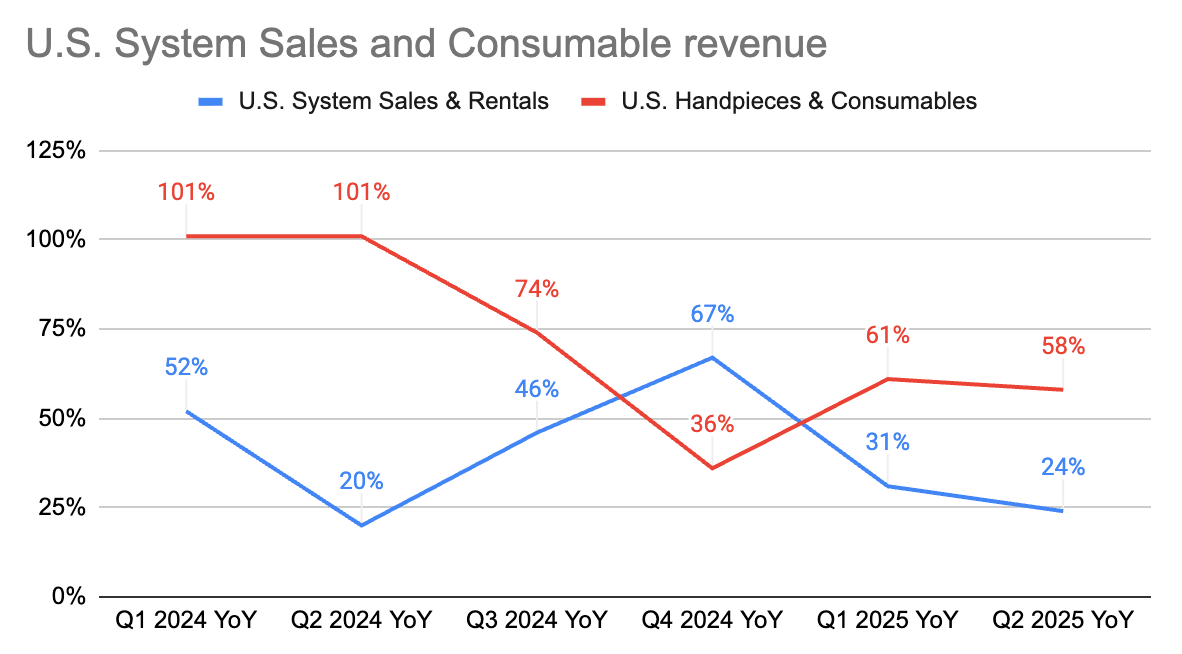

Handpiece sales are a significant driver of revenue growth, with U.S. handpiece and consumables revenue increasing by 58% to $43.1 million in Q2 2025.

Service and Repair, and Extended Service Contracts: The company also generates revenue from service and repair, and extended service contracts with existing customers.

Financial Highlights

Q2 2025

PROCEPT’s financial highlights for Q2 2025 demonstrate significant growth across key revenue streams and improved profitability metrics.

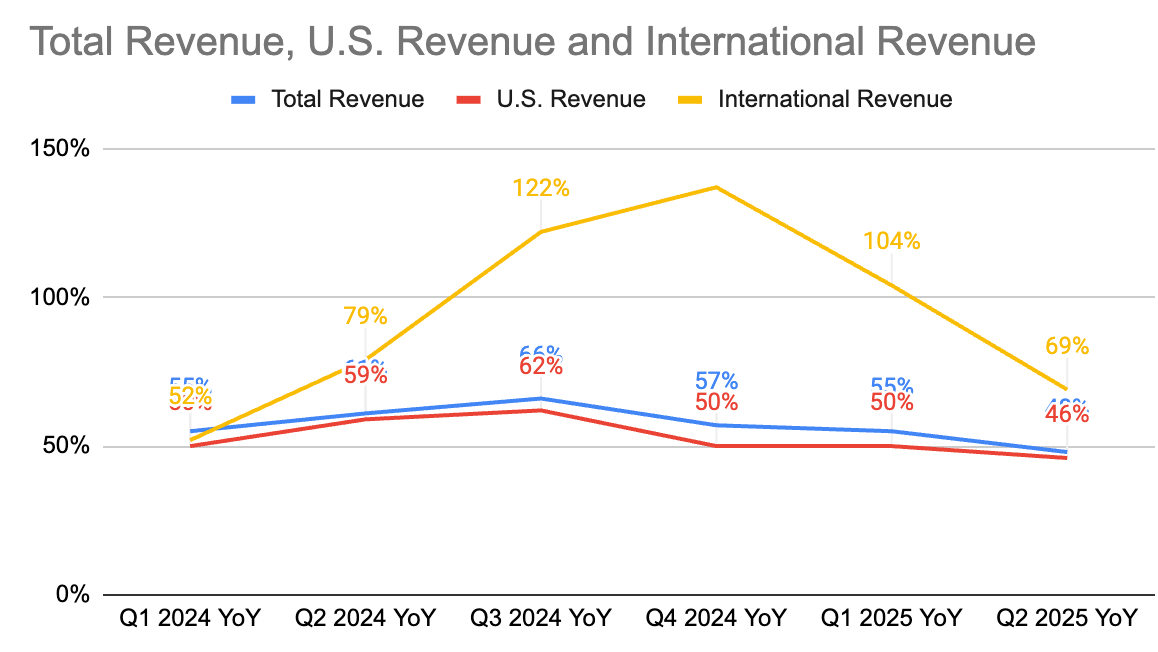

Total revenue of $79.2 million for Q2 2025, a 48% increase compared to Q2 2024; an increase of 52% for the six months ended June 30, 2025, compared to the same period in 2024.

Gross Margin: Gross margin for Q2 2025 was 65%, an increase from 59% in the prior year period and 64% in Q1 2025. The year-over-year margin expansion was driven primarily by improved operational efficiencies and higher average selling prices on U.S. robotic systems. For the six months ended June 30, 2025, gross margin increased to 65% compared to 58% for the same period in 2024.

Operating Expenses: Total operating expenses amounted to $73.9 million in Q2 2025, compared with $58.3 million in the prior year period. This increase was primarily due to expenses to expand the commercial organization, increased research and development expenses, and increased general and administrative expenses.

Net Loss: The company's net loss was $19.6 million for Q2 2025, an improvement compared to a loss of $25.6 million in the prior year period. For the six months ended June 30, 2025, net loss was $44.3 million compared to $51.6 million for the same period in 2024.

Adjusted EBITDA: Adjusted EBITDA for Q2 2025 was a loss of $8.0 million, an improvement from a loss of $17.9 million in the prior year period.

Cash, Cash Equivalents, and Restricted Cash: As of June 30, 2025, these balances totaled approximately $305.8 million.

Other Noteworthy Points from Q2 2025:

Over 1,300 surgeons performed an Aquablation therapy procedure, indicating strong engagement within the surgeon community.

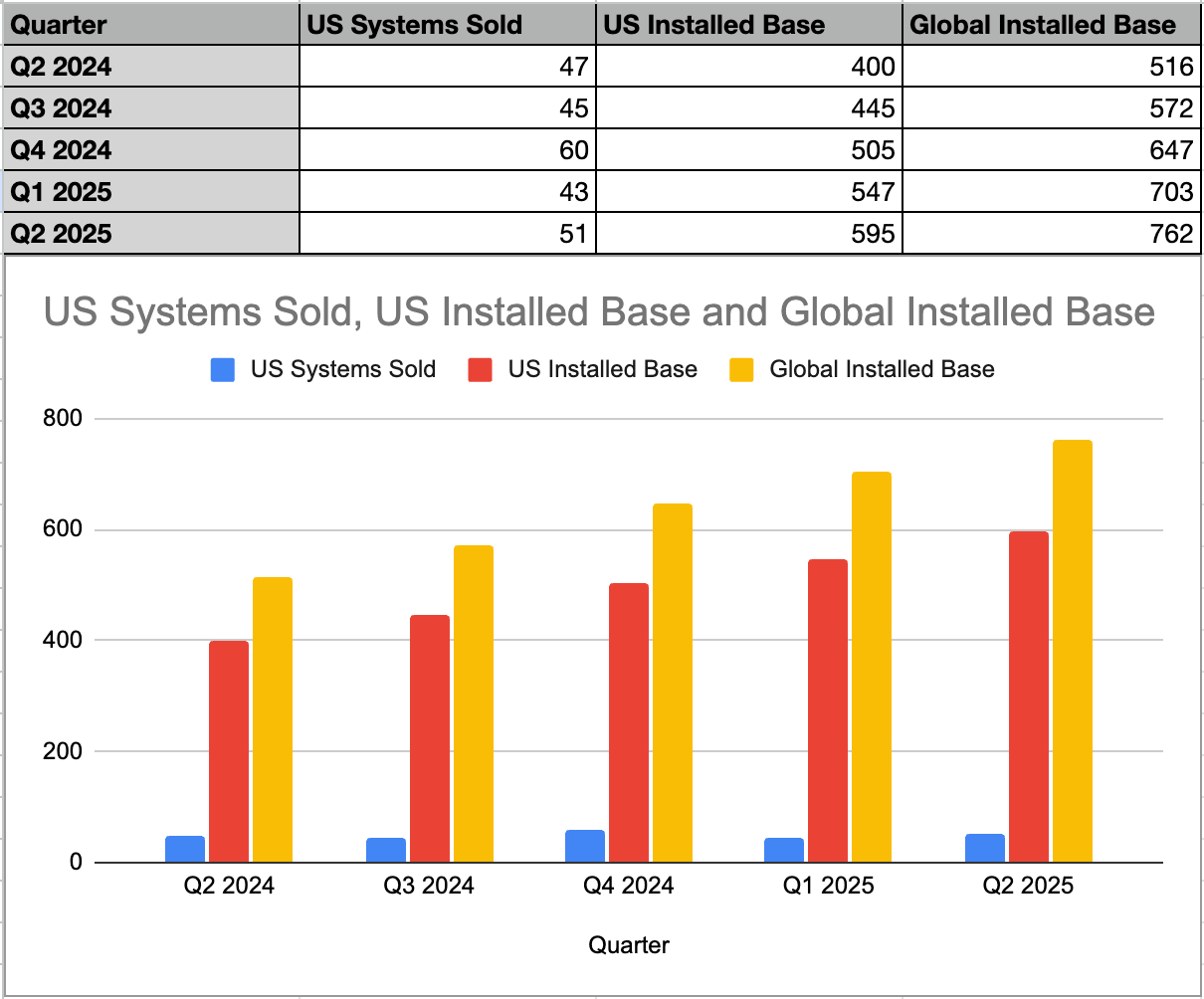

The installed base of robotic systems in the U.S. reached 595 systems as of June 30, 2025.

Globally, the installed base was 762 robotic systems as of June 30, 2025.

PROCEPT BioRobotics also increased its fiscal year 2025 total revenue guidance to $325.5 million, representing a 45% increase compared to the prior year.

Revenue Breakdowns

By Geography:

Q2 2025 U.S. Revenue: $69.6 million, representing a 46% growth compared to the prior year period. This accounted for 88% of total revenue.

Q2 2025 International Revenue: $9.6 million, an increase of 69% compared to the prior year period. This accounted for 12% of total revenue. Growth was primarily driven by strong sales momentum in the United Kingdom, Japan, and Korea.

By Type (U.S. and International Combined):

Q2 2025 System Sales and Rentals: $25.0 million, representing a 20% increase compared to Q2 2024.

In the U.S., 48 new HYDROS robotic systems and replacement systems were sold. U.S. system and rental revenue was $22.1 million, an increase of 24% compared to the prior year period. The average selling price for greenfield systems was approximately $455,000.

Outside the U.S., system sales and rentals were $2.9 million.

Q2 2025 Handpieces and Other Consumables: $49.1 million, representing a 66% increase compared to Q2 2024.

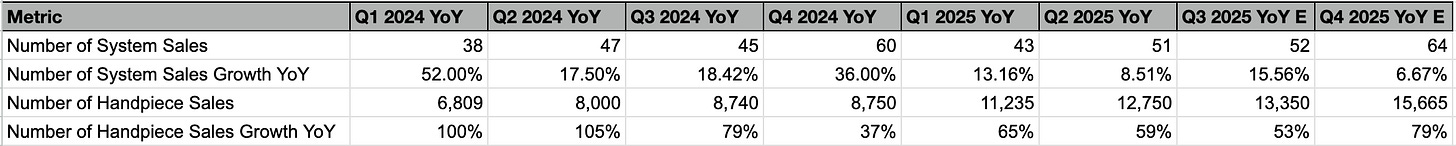

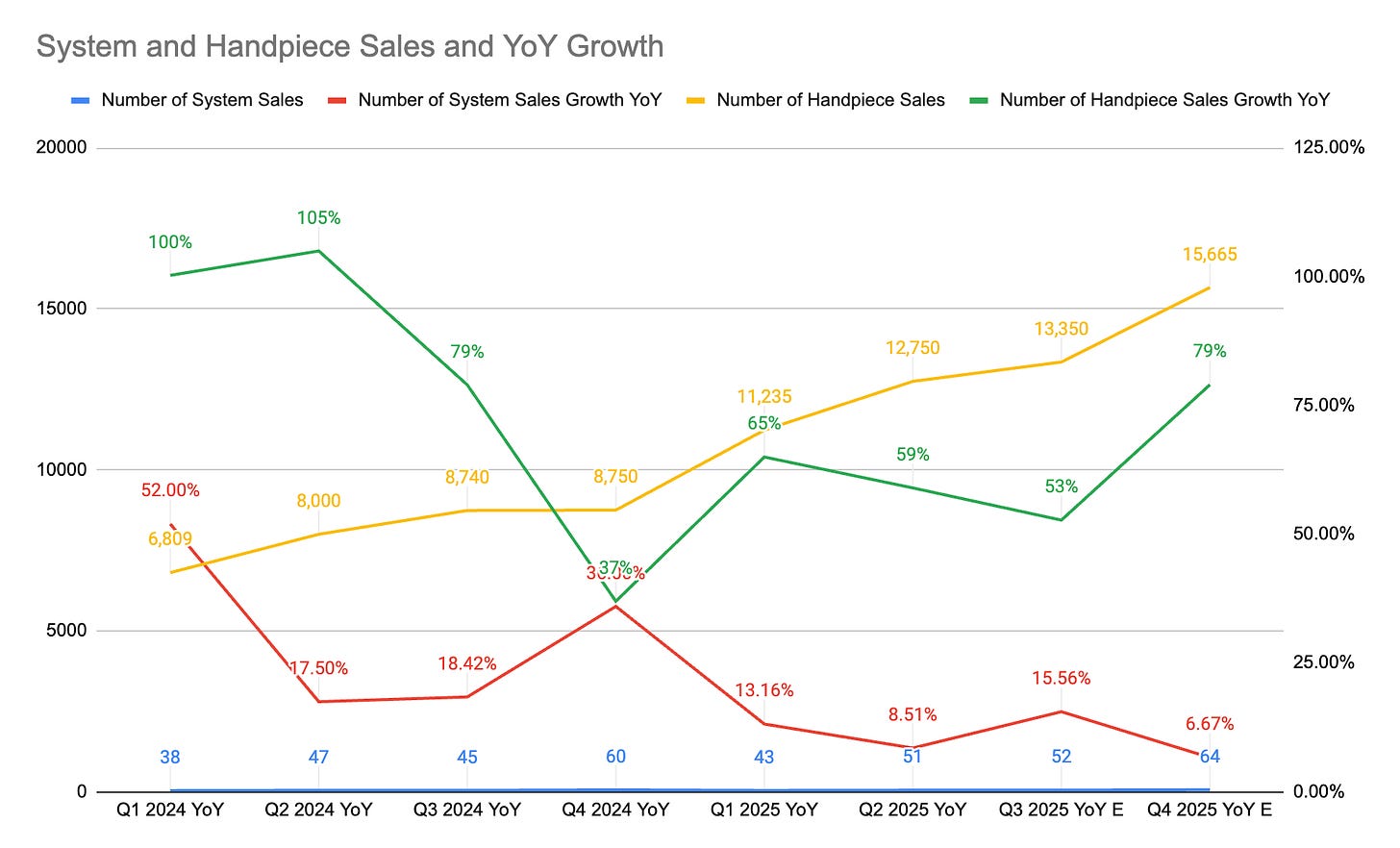

U.S. handpiece and consumables revenue was $43.1 million, an increase of 58% compared to the prior year period. Approximately 12,750 handpieces were sold in the U.S., representing a 59% year-over-year unit growth.

Outside the U.S., handpieces and other consumables were $6.0 million.

Q2 2025 Service: $5.0 million, representing a 72% increase compared to Q2 2024.

U.S. service revenue was $4.4 million.

Outside the U.S., service revenue was $0.7 million.

Installed Base

PROCEPT's management is actively pursuing an aggressive strategy to expand its installed base, particularly with the new HYDROS system and strategic IDN partnerships.

Unit Sales and Growth

Capital equipment deal closures can vary quarterly due to hospital budgets, even with a strong sales funnel. Elective procedures, however, are typically booked months in advance, providing some stability.

Global macroeconomic factors, such as inflation or budget constraints, can influence hospital capital budgets. A significant example was the acute saline shortage in Q4 2024 and early Q1 2025, which led to an estimated delay or cancellation of up to 2,000 Aquablation procedures, directly impacting handpiece and new account launches.

The company actively engages with IDNs at a corporate level to build strategic partnerships, aiming for a more predictable capital sales funnel and process

Growth Strategy

BPH Treatment Expansion

Install Base Growth: Drive wider adoption of Aquablation therapy in U.S. by focusing on high-volume hospitals and IDNs. HYDROS™ next-gen system expected to boost adoption. Replacement cycle begins in 2026.

Insurance Coverage: Nearly all eligible U.S. patients already have Medicare or commercial payor coverage; new CPT Category I code (effective Jan 2026) to drive further adoption.

International Growth: Expansion in UK, Japan, and additional markets, supported by endorsements and reimbursement progress.

Prostate Cancer (Investigational)

Prostate cancer is the most commonly diagnosed cancer in men in the U.S. after skin cancer, with approximately 300,000 new cases each year. More than 3 million men are currently living with prostate cancer, and about 70% of diagnoses present as localized disease (Grade Group 1-3), which is the main target for Aquablation therapy. While treatment options for localized prostate cancer exist, they often require patients to choose between effective cancer control and preserving quality of life, as procedures like radical surgery can lead to impotence and incontinence. Many patients with low or intermediate-risk prostate cancer opt for active surveillance, but 30% experience disease progression within a year and 60% ultimately undergo radical surgery. Efforts to address cancer with focal therapies face significant challenges because prostate cancer is frequently multifocal, meaning additional cancerous lesions may be missed during MRI or biopsy.

The Aquablation technique for prostate cancer is distinct from the BPH technique, aiming for a near-total resection of the prostate, including the peripheral zone where most cancers reside, while preserving critical structures like nerve bundles. This involves more passes (3-5+) compared to BPH (2 passes).

Only company with FDA IDE for randomized PCa surgical trial. Targeting FDA indication for localized prostate cancer—an unmet need due to side effects of current treatments.

Investing in clinical trials PRCT001, PRCT002 (feasibility), and pivotal WATER IV PCa trial against radical prostatectomy. (In these trials, researchers aim to compare two or more surgical options for treating prostate cancer.) Using existing BPH network to accelerate trial enrollment and future adoption.

The long-term goal is to achieve a prostate cancer-specific indication and expand the market by offering a treatment that minimizes the trade-offs in quality of life. Regulatory approval and launch expected 2027–2028, pending successful trials.

Risks

Tariffs: Primary exposure from ultrasound system components sourced from China. Estimated potential COGS headwind for 2025 was $5 million based on 145% tariff, now revised to $1-2 million with tariffs at approximately 55%. Operational mitigation strategies are being pursued.

Competition: Faces competition from larger companies and other BPH treatment modalities (resective and non-resective).

Healthcare Reform: Continuously subject to legislative and regulatory changes, including cost-containment measures and reimbursement policies. This brings more challenge to their single product portfolio that evolve around Aquablation therapy.

Leadership Transition: Reza Zadno stepping down as CEO, Larry Wood appointed as the new CEO effective September 2, 2025. Hisham Shiblaq (Chief Commercial Officer) also separating from the company effective September 1, 2025, with roles split into SVP of Sales and SVP of Marketing.

Valuation

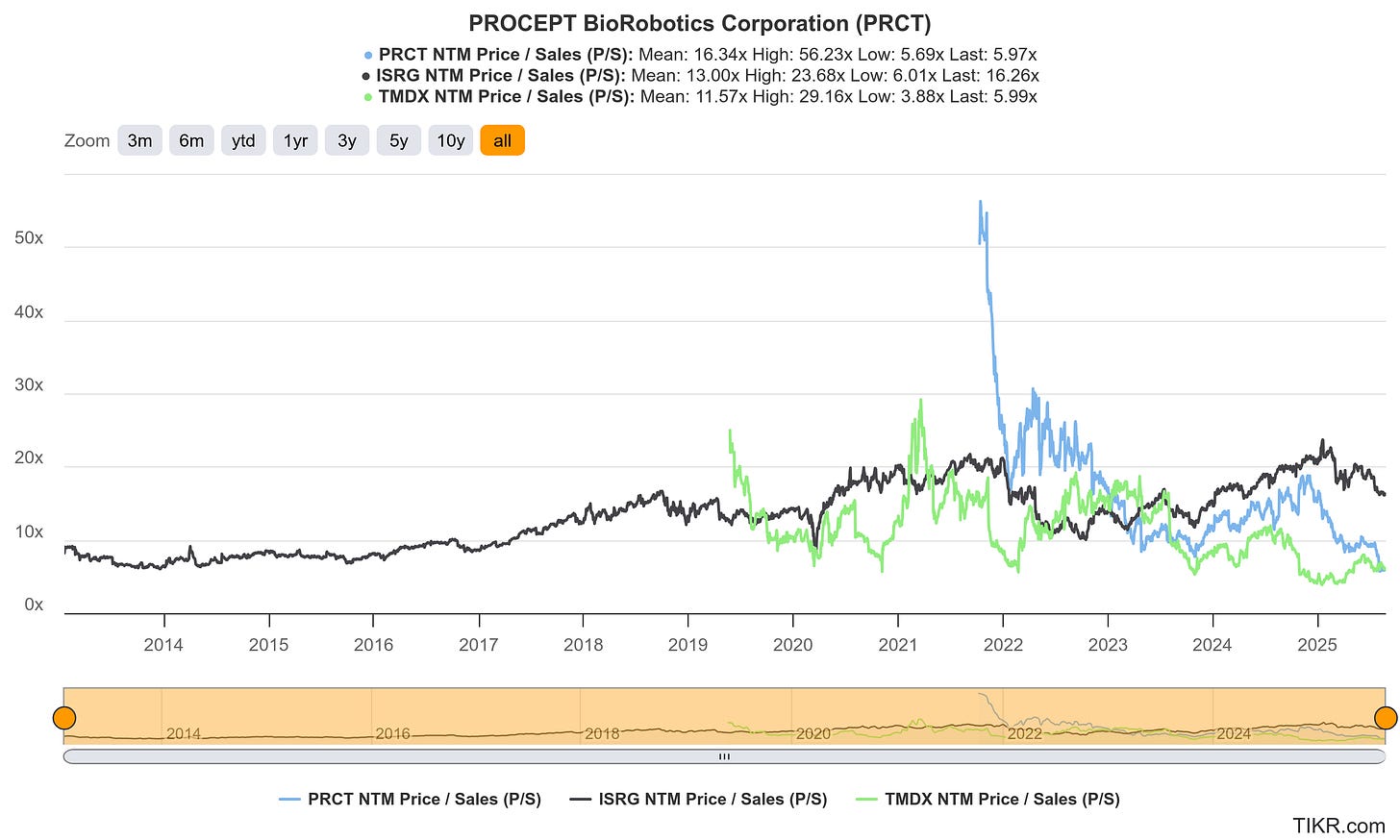

Since PROCEPT is still not profitable business there is no easy valuation. Here, we will compare their P/S multiple to Transmedics (TMDX) and Intuitive Surgical (ISRG). As shown below PRCT’s P/S is cheapest among the three while growing the fastest among them. FWD 2yr revenue CAGR for PRCT is over 37%.

Conclusion and Final Thoughts

PROCEPT BioRobotics has carved out a distinct leadership position in urologic surgical robotics with Aquablation therapy. While the company faces typical risks of scaling and competition, its revenue growth, expanding market opportunities, and strong clinical backing make it a compelling growth story for investors looking to capitalize on innovation in healthcare. Continued execution and market uptake will be key to unlocking long-term value.

I remain cautious about their execution strategy, as system sales growth has slowed to single digits. Additionally, management has revised their guidance downward for replacement units, tempering expectations for overall system growth. While seasonality plays a role, system sales growth for 2025 is already tracking around 10%, which suggests high single-digit growth is likely for 2026 as well. Regarding the cancer application, the earliest possible commercial launch for the targeted prostate cancer indication is in the second half of 2027, contingent on follow-up data and regulatory milestones. Given these factors, I see a lack of near-term catalysts for PROCEPT, and expect the stock to remain in its current price range for some time, and, hence I am in no rush to take a position.

The Content is not, and should not be construed as, investment advice, financial advice, or a recommendation to buy, sell, or hold any security or other financial instrument. We do not provide personalized financial planning or investment services. Always consult with a qualified financial professional before making any investment decisions. Reliance on any information provided by PennyInsight is solely at your own risk.

Wow, very high quality write up! I'm working on my article for next week too but I'm totally aligned with you!