How We Unlocked Tax-Free Investment Growth

A step-by-step guide to the backdoor Roth IRA strategy for high earners in the U.S.

Four years ago, we decided to get serious about building wealth. We were earning well, saving aggressively, and thinking long term—early retirement, financial independence, the whole picture.

Naturally, our first instinct was to stuff as much money as possible into tax-advantaged accounts. The idea was simple: why pay taxes later if we could pay now and let our investments grow tax-free?

That’s when we discovered Roth IRAs.

On paper, Roth IRAs looked perfect—invest after-tax dollars, and watch them grow forever tax-free. No taxes on dividends, no taxes on capital gains, and no required minimum distributions in retirement. But when we looked into it, we hit a wall.

Our income was too high to contribute directly. We were already over the IRS income threshold for Roth contributions, and while we could still put money into a Traditional IRA, those contributions would be after-tax and taxed again when withdrawn in retirement.

That felt inefficient at best, double-taxed at worst.

So we went searching for a better way—and that’s when we discovered the Backdoor Roth IRA.

⚠️ Disclaimer: We’re not tax professionals or CPAs. This post reflects our personal experience as investors and should not be considered financial or tax advice. Always consult a qualified tax advisor before making any decisions. We also file taxes in the United States, so this strategy may not apply to your situation if you’re in a different country or tax system.

Why Roth IRAs Are a Hidden Gem

If you’re in the wealth-building stage of life, a Roth IRA might be the most powerful compounding vehicle available to you. Why?

✅ Tax-free growth for decades

✅ Tax-free withdrawals in retirement

✅ No required minimum distributions (RMDs)

✅ No taxes on dividends or capital gains

✅ Ideal for early retirement (especially with Roth ladders—each conversion becomes tax- and penalty-free after 5 years)

In 2025, the contribution limits are:

$7,000 per person (under age 50)

$8,000 per person (50 or older)

For a couple like us, that means up to $14,000 annually in tax-free compounding power.

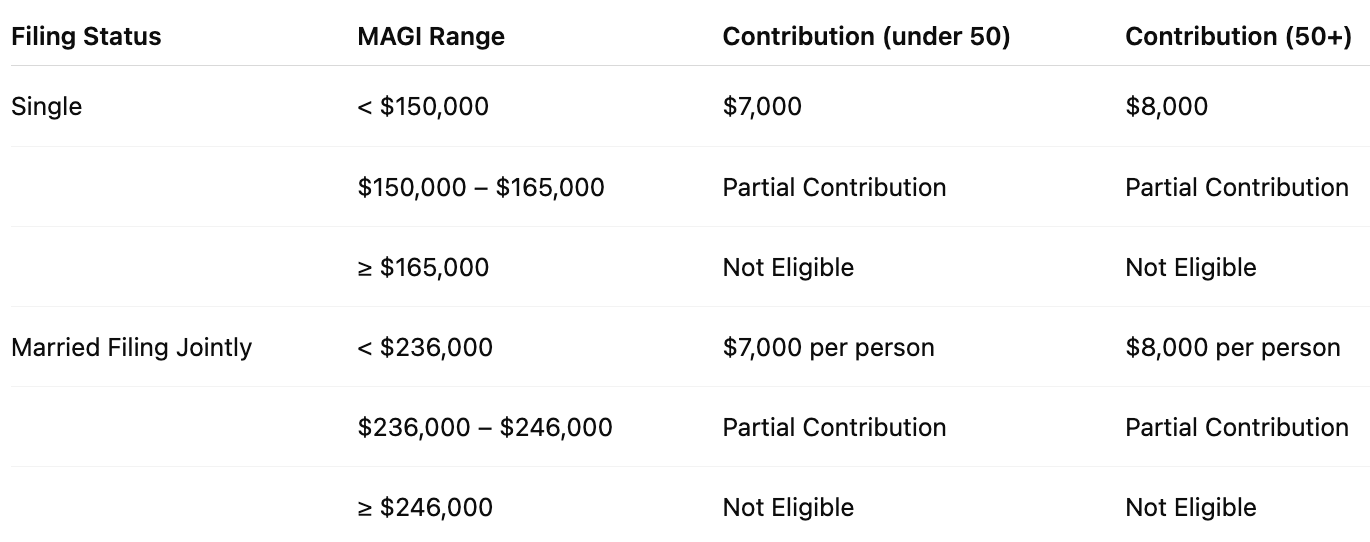

But only if your income doesn’t exceed the IRS limit—determined by your Modified Adjusted Gross Income, or MAGI.

Roth IRA Income Limits for 2025

Modified Adjusted Gross Income (MAGI) is your Adjusted Gross Income (AGI) from your tax return, with some deductions added back—such as student loan interest, foreign income exclusion, and IRA contributions. The IRS uses MAGI to determine eligibility for Roth IRA contributions.

The Backdoor Roth IRA Strategy

Here’s the exact method we used to bypass the income limits—completely above board, and still allowed in 2025.

Step 1: Contribute After-Tax to a Traditional IRA

We each opened a Traditional IRA and contributed $7,000 of after-tax dollars.

These contributions weren’t deductible (because of our income level), but that’s okay. We weren’t looking for a tax break now—we were playing the long game.

Step 2: Convert to a Roth IRA

Immediately after the contribution, we converted the full amount to a Roth IRA. Since the money was after-tax and there were no investment gains in between, there were no additional taxes owed.

Step 3: File IRS Form 8606

This form tracks non-deductible IRA contributions and Roth conversions. It ensures we don’t pay taxes again on the money we’ve already paid taxes on. Most tax software (like TurboTax) fills this out automatically.

Why You Must Watch Out for the Pro-Rata Rule

Here’s where things can go wrong—and where we nearly made a mistake the first time.

If you have pre-tax money in any IRA—including Traditional, Rollover, or SEP—the IRS looks at all your IRA balances together when you do a Roth conversion. This is the pro-rata rule.

So even if you only contribute new after-tax dollars, your conversion will be partially taxed based on the ratio of pre-tax to total IRA funds.

Our Fix: Roll Everything Into a 401(k)

We rolled all old IRA balances into our employer’s 401(k) plan (which accepted rollovers). That cleared the slate, letting our after-tax IRA contribution convert cleanly to Roth.

💡 Pro Tip: Never roll over an old 401(k) into an IRA if you plan to use the backdoor Roth strategy. That pollutes your IRA and creates tax headaches down the road.

Do This for Both Spouses

Because we file jointly, we were able to do this for both of us—effectively doubling the benefit.

If you’re married and your spouse has no income, they can still make a spousal IRA contribution based on your earned income. In 2025, that’s $14,000/year growing tax-free together.

This is one of the easiest and most powerful tax strategies for dual-income or single-earner families.

Our Take: The Best Legal Tax Shelter Most High Earners Miss

If your income disqualifies you from direct Roth IRA contributions, the backdoor Roth IRA gives you a clean, repeatable workaround.

It’s not complicated. But it does require attention to detail and clean execution.

Here’s a Quick Summary:

✅ Contribute to Traditional IRA (after-tax)

✅ Rollover any pre-tax IRAs to 401(k) first

✅ Convert to Roth IRA

✅ File Form 8606

✅ Repeat for spouse

✅ Consider a Roth ladder if planning for early retirement—each conversion becomes tax- and penalty-free after 5 years.

We’ve done this for four straight years now—and the tax-free compounding power is starting to show. It’s not sexy. But it works. And it’s a move we plan to repeat every single year we’re eligible.

Let us know in the comments if you’ve used the backdoor Roth strategy—or if you’re considering it this year. We’d love to hear your experience.