GitLab Inc. (GTLB), A comprehensive DevSecOps Platform

Unified platform, accelerating AI, and rising profitability make GitLab a strategic long-term bet—despite valuation headwinds and fierce competition.

GitLab's mission statement is "to ensure that everyone can contribute". They offer a comprehensive DevSecOps platform that began as an open-source project in 2011. Operating on an all-remote model since its inception, the company's vision is shaped by the evolving needs of software development.

Organizations today often use multiple DevOps tools (e.g., 84% use 2-10 tools), and 69% of developers spend at least a quarter of their time maintaining and integrating these toolchains, with 64% desiring consolidation. This fragmented landscape resulted in significant manual work, increased security vulnerabilities, and slowed down software delivery.

Recognizing these challenges, GitLab pioneered "The DevSecOps Platform," a fundamentally new approach that replaces the DIY DevOps model. The core idea was to provide a complete DevSecOps platform as a single application with native AI-assisted workflows, a unified data model, and a single interface. This unification enables all stakeholders across the software delivery lifecycle—development, operations, security, IT, and even business teams—to work together within one tool and a single workflow.

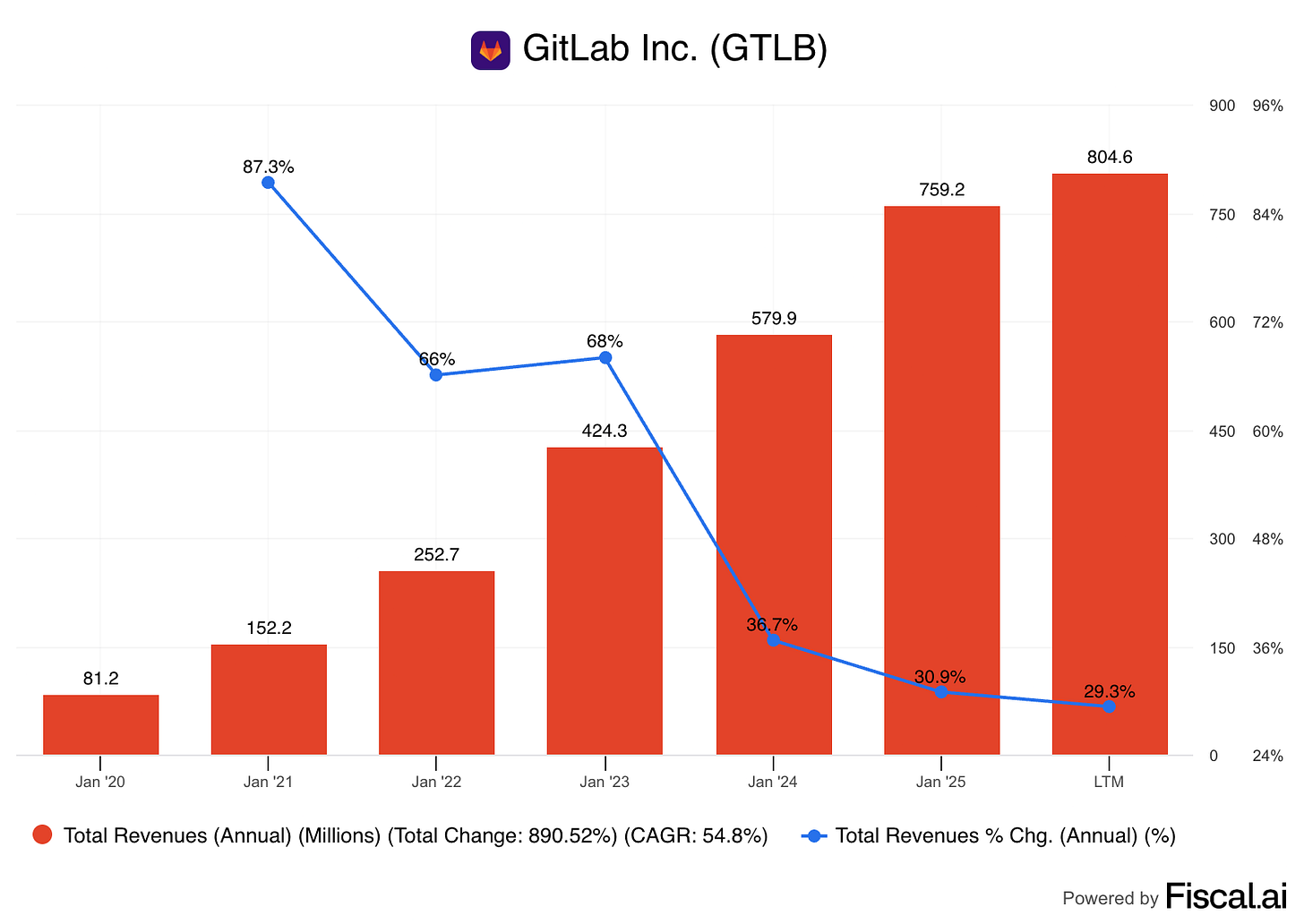

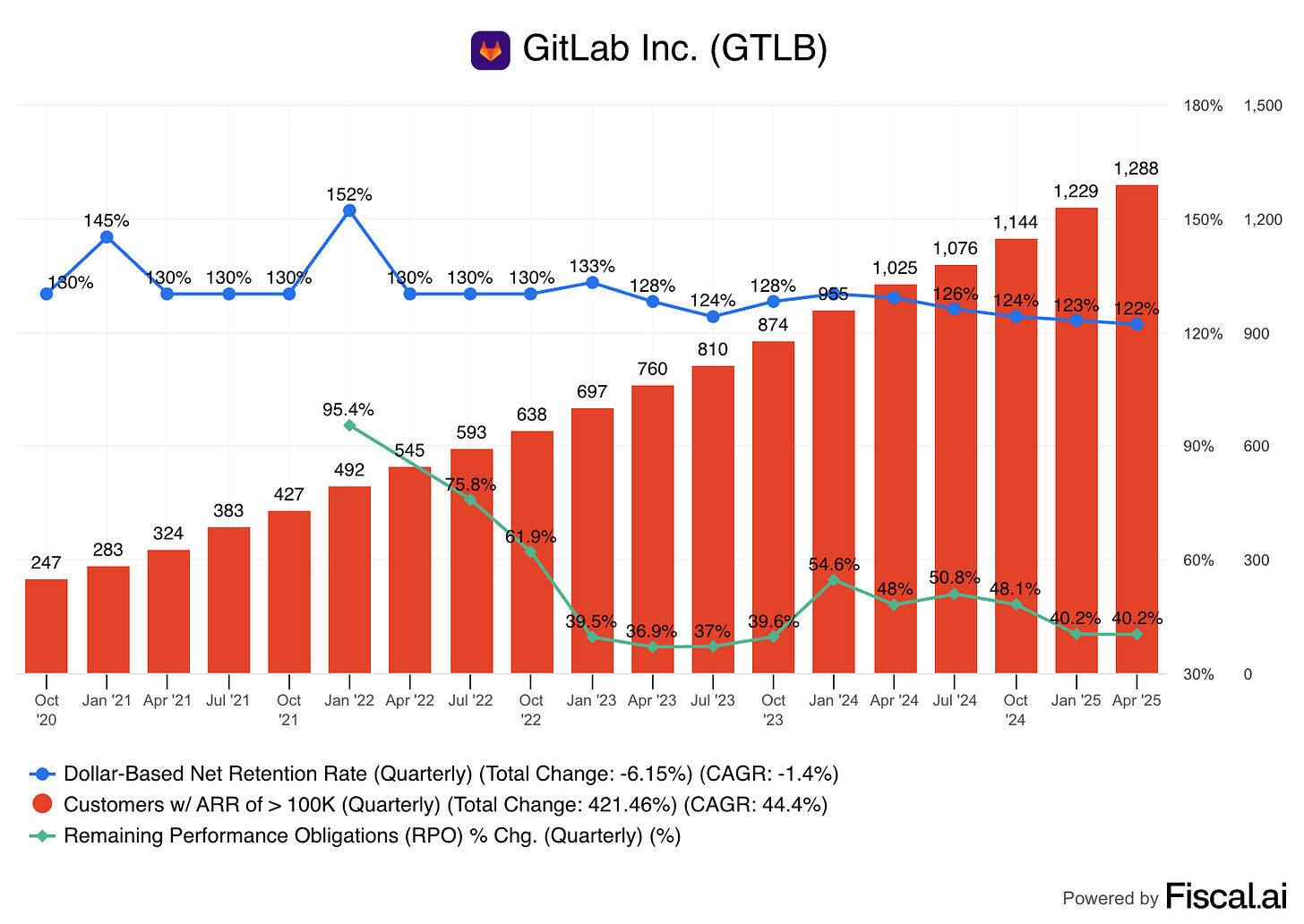

GitLab has grown to serve over 50 million registered users, with more than 50% of Fortune 100 companies as customers. The company has shown strong financial growth, with revenue reaching $759.2 million in fiscal year 2025 (ended January 31, 2025), representing 31% year-over-year growth, and a strong 122% dollar-based net retention.

Despite the fundamentals, the market doesn’t love GTLB stock, and it has been down 68% from all-time high and down 44% from last year's high. Despite the market’s reaction GitLab is still poised for over 23% revenue CAGR for next two years. In this deep dive, I discuss the investment thesis of GitLab.

The Problem of Fragmented Reality

The modern software development lifecycle, particularly within the DevSecOps paradigm, is frequently hampered by significant toolchain complexity. Research indicates that a substantial portion of IT professionals, specifically 45%, utilize three or more distinct tools for software delivery, with two-thirds of this group managing eleven or more tools within a single toolchain. This fragmentation creates a multitude of inefficiencies and risks that impede software development velocity and quality.

One of the primary challenges arising from this complexity is the elimination of silos (How GitLab CI helps solve common DevSecOps challenges). Disconnected tools and environments inherently isolate development, security, and operations teams, leading to communication breakdowns and bottlenecks that ripple throughout the entire development lifecycle. This lack of integration prevents a holistic view of projects and processes.

Furthermore, the fragmented nature of the toolchain results in a profound lack of visibility and collaboration. Without a unified perspective, it becomes exceedingly difficult for teams to identify performance bottlenecks, troubleshoot problems efficiently, fix bugs promptly, or maintain agile development practices. Individuals are often unaware of the work being done by other team members or the status of processes that contribute to the final product.

The consequence of this disunity is pervasive context switching and operational inefficiency. Developers are compelled to constantly juggle multiple environments and tools, diverting their valuable time and mental energy from core application building to managing disparate environments. Similarly, operations teams frequently find themselves in a reactive "firefighting" mode, addressing issues stemming from brittle pipelines and the intensive maintenance required for plugin-heavy environments. This fragmented approach significantly delays troubleshooting and reduces overall productivity across the organization.

The GitLab Solution

GitLab's latest solutions, as described in their Annual Report on Form 10-K for the fiscal year ended January 31, 2025, are centered around its comprehensive DevSecOps platform and significant advancements in AI and security integration:

The DevSecOps Platform: GitLab provides a complete DevSecOps platform delivered as a single application, designed to address major business transformation needs across all industries and company sizes. This unified platform aims to shorten the time from idea to customer value by integrating the entire development experience. It also helps customers reduce costs by consolidating multiple point products, thereby eliminating the hidden costs and time associated with manual integrations. The platform covers all stages of the DevSecOps lifecycle: Plan, Create, Verify, Secure, Package, Release, Configure, Monitor, and Govern. Key capabilities include:

Create: Helps teams design, develop, and securely manage code and project data from a single distributed version control system to enable rapid iteration.

Verify: Facilitates Continuous Integration (CI) to automate builds, integration, and code verification, including automated testing and code quality analysis for faster feedback.

Enterprise Agile Planning: A solution within the Ultimate tier that enables organization-wide change by improving collaboration between development, operations, and security teams, and implementing full value stream measurement, analytics, and reporting.

AI-Powered DevSecOps Platform: GitLab is positioned as an "AI-powered DevSecOps platform" that enhances developer productivity, improves operational efficiency, and strengthens security and compliance. This includes capabilities that allow customers to plan, build, manage, and deliver software more efficiently and securely. Current AI-powered solutions include:

GitLab Duo Pro: A paid add-on that includes Code Suggestions, Chat, and organizational control capabilities.

GitLab Duo Chat: A conversational AI interface integrated into the DevSecOps lifecycle, helping users understand project status, get help with planning and configuration, and generate tests.

GitLab Duo Enterprise: An end-to-end AI add-on that embeds secure AI-driven capabilities across the software development lifecycle, and can allow customers to deploy AI models in air-gapped environments.

AI privacy controls: Features enabling organizations to control sensitive data at project, group, and subgroup levels to manage security and compliance risks associated with AI adoption.

AI Transparency Center: Launched to provide customers with better understanding of how GitLab upholds ethics and transparency in its AI-powered features.

Integrated Security and Compliance: Security is a core component, with a focus on "shifting left" to embed security earlier in the development process to reduce vulnerabilities and improve software quality and compliance.

GitLab enhanced its security offerings through the acquisitions of Oxeye and Rezilion, which led to the introduction of a "differentiated Advanced SAST solution" and will streamline vulnerability management and remediation.

GitLab Dedicated: This is a single-tenant Software-as-a-Service (SaaS) solution tailored for organizations with complex security and compliance requirements, offering data isolation and residency benefits.

Flexible Deployment Options: GitLab offers its platform through various deployment models to meet diverse customer preferences:

Self-managed: Customers install GitLab in their own on-premise or hybrid cloud environments.

SaaS: The platform is managed by GitLab and hosted in public or private clouds. GitLab also provides GitLab Dedicated as a single-tenant SaaS offering.

Continuous Innovation: The company emphasizes rapid innovation through an iterative development approach, consistently releasing new versions of its software monthly. As of January 31, 2025, GitLab had maintained this monthly release cadence for 160 consecutive months. This high velocity of innovation is supported by an open-core business model, leveraging both internal research and development and contributions from its large global open-source community.

Market Opportunity

GitLab is experiencing significant growth, driven by a confluence of macro, technological, and security-focused trends shaping the DevOps and DevSecOps markets.

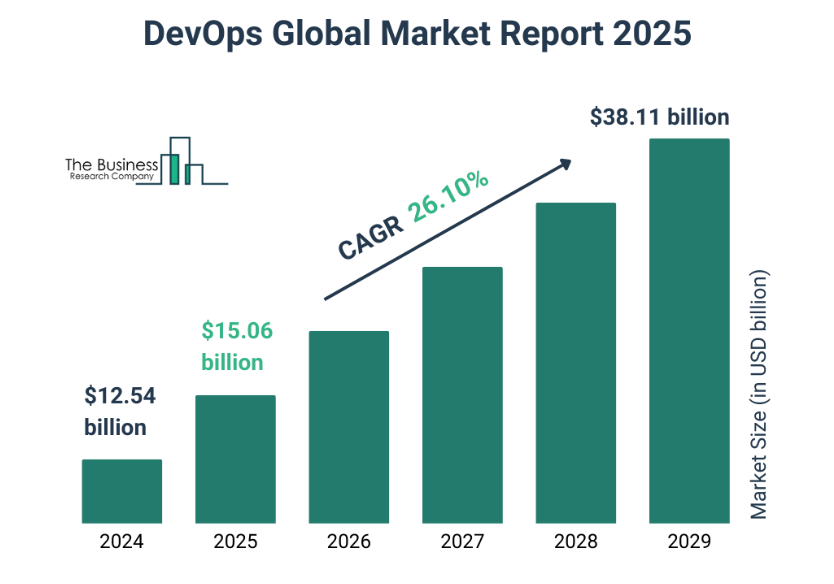

https://www.thebusinessresearchcompany.com/report/devops-global-market-report

The broader DevOps market was valued at $12.54 billion in 2024 and is projected to grow to $15.06 billion in 2025 at a Compound Annual Growth Rate (CAGR) of 20.1%. It is forecasted to reach $38.11 billion by 2029, exhibiting a robust CAGR of 26.1%. Another report estimates the DevOps market will reach $38.45 billion by 2030, growing at a CAGR of 25.2% during the period 2024-2030.

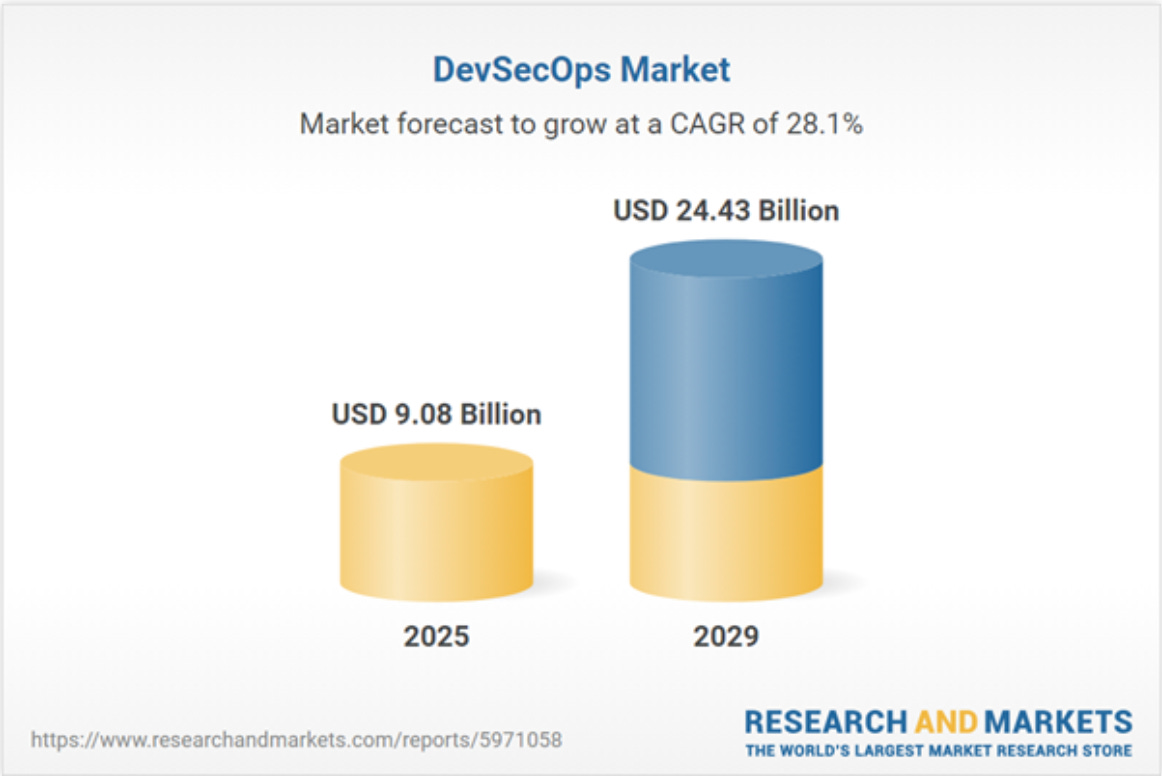

https://www.researchandmarkets.com/reports/5971058/devsecops-market-report

The more specialized DevSecOps market demonstrates even more aggressive growth. It was valued at $7.07 billion in 2024 and is projected to reach $9.08 billion in 2025 at a CAGR of 28.5%. This segment is expected to grow to $24.43 billion by 2029 at a CAGR of 28.1%. Geographically, North America was the largest region in both the DevOps and DevSecOps markets in 2024, with Asia-Pacific anticipated to be the fastest-growing region in the forecast period.

GitLab is strategically positioned to capture a significant share of this expanding market. The company explicitly targets the broader $12 billion DevOps market and, more strategically, the higher-growth DevSecOps segment through its branding as a "complete DevSecOps platform." The primary drivers of this market's growth are identified as the increasing integration of AI and ML for automation and optimization, along with the heightened focus on embedding security early in the development lifecycle through DevSecOps. Furthermore, GitLab's strategic initiatives, such as its dedicated push into large enterprises via "GitLab Dedicated" and partnerships with major cloud providers like Amazon and Google Cloud, directly expand its Serviceable Addressable Market. The recent achievement of FedRAMP Moderate certification for "GitLab Dedicated for Government" is particularly significant. This certification unlocks highly regulated and lucrative public sector opportunities by removing critical barriers to entry and building trust.

Competitive Landscape and GitLab’s Position

The DevOps and DevSecOps space is crowded, featuring established players, integrated platforms, and specialized tools:

Key Competitors:

Microsoft GitHub – Deep integration with Microsoft ecosystem; massive open-source community.

Atlassian (Bitbucket, Jira) – Strong in project management with integrated CI/CD tools.

Azure DevOps – Powerful, customizable pipelines tightly coupled with Microsoft infrastructure.

Specialized Tools – SonarQube, Veracode, Coverity, Snyk, Black Duck, Mend.io, Ansible, and others excel at specific functions like security, code quality, or automation.

GitLab’s Advantages

All-in-One DevSecOps: GitLab integrates the entire software lifecycle—planning, coding, testing, security, and deployment—into a single platform, avoiding the complexity of multi-tool setups.

AI-Native, Cloud-Agnostic: Unlike rivals with bolt-on AI, GitLab’s AI capabilities are natively built in, cloud-agnostic, and model-neutral—supporting air-gapped environments.

Open-Source Foundation: Community-driven development promotes innovation, transparency, and acts as a powerful GTM engine—driving adoption from the free tier to paid plans.

Cost Efficiency: More affordable than assembling multiple best-of-breed tools. GitLab often replaces tools like SonarQube or Veracode, cutting software licensing costs by 25% and reducing IT admin overhead by 75%.

Quantified Impact

According to a Forrester TEI Study:

483% ROI over 3 years

400% increase in developer productivity

15× faster initial software release

5× less time spent on security tasks

$4.3M potential savings from retiring legacy tools

These metrics highlight GitLab’s ability to deliver real, measurable outcomes—particularly for enterprises focused on toolchain simplification, security, and speed.

Challenges to Note

Steeper Learning Curve: Feature-rich platform can be overwhelming for new users.

Community Size: Smaller than GitHub’s for open-source contributions.

Free Tier Limits: Security scans and CI/CD minutes are restricted on the free plan.

Upfront Cost: May appear higher than newer point solutions like Mend.io.

Bottom Line: Why GitLab Wins

Despite stiff competition, GitLab’s integrated, AI-native platform is not just a convenience—it’s a strategic asset. It simplifies workflows, cuts costs, and boosts productivity at scale. Its open-source roots and strong developer focus give it a defensible moat, while its growing enterprise adoption and measurable ROI make it a compelling choice in the evolving DevSecOps landscape.

Economic Moat

GitLab has a strong brand in the DevSecOps platform space. It's recognized as a leader by Forrester Research. The platform's integrated nature, combining CI/CD, project management, and security features, creates a unique offering. However, the software industry is dynamic, and brand alone may not be a sufficient moat.

GitLab creates switching costs through its tight integration into its clients' software development workflows. Once a company integrates GitLab into its processes, switching to a competing platform can be costly and disruptive. The documented ROI of 483% in three years and payback periods of less than six months suggests significant integration and cost savings for customers, further solidifying these switching costs.

The platform benefits from network effects. As more developers and teams use GitLab, the platform becomes more valuable due to increased collaboration and a larger ecosystem. The platform's open-core model also fosters community engagement, further strengthening the network effect.

GitLab has achieved impressive gross margins, above 88%. This indicates a strong ability to manage costs. However, this does not provide enough information to determine if these cost advantages are sustainable.

It’s sufficient to say, as a software service company it has a weak to moderate economic moat primarily driven by switching cost.

Management Quality and Track Record

GitLab's leadership team comprises experienced professionals with a strong track record in the software industry. The Executive Group includes Bill Staples (Chief Executive Officer), Brian Robins (Chief Financial Officer), Sabrina Farmer (Chief Technology Officer), David DeSanto (Chief Product Officer), and other key functional leaders.

Sid Sijbrandij, the co-founder and former CEO, played a pivotal role in shaping GitLab's vision. His entrepreneurial spirit and love for automating processes led him to co-found GitLab in 2011. He transformed GitLab from a simple project management tool into a comprehensive DevOps platform, challenging industry giants and pioneering the all-remote work model. His decision to embrace an all-remote company culture, despite initial skepticism from investors, proved effective in driving productivity and attracting diverse talent. He still owns 9.85% of the company, and leads through being Executive Chair of the company. This shows his skin in the game, and confidence in the company.

William "Bill" Staples is the Chief Executive Officer of GitLab Inc., a position he assumed on December 5, 2024. He also serves as a member of GitLab's board of directors, having joined in December 2024. Staples was appointed CEO following the resignation of co-founder Sytse Sijbrandij, who transitioned to Executive Chair of the board. Before joining GitLab, Staples held executive roles at New Relic, Adobe, Microsoft, and Citrix, bringing over two decades of leadership in product, engineering, and operations across top tech companies.

The company's all-remote model and the open-sourcing of its internal processes, documented in over 6,000 pages of public handbook content, demonstrate a deep commitment to transparency and iteration. GitLab boasts a strong reputation among its employees, with an average rating of 4.2 out of 5 stars based on 635 company reviews on Glassdoor. This high rating, coupled with 76% of employees recommending it to a friend and 79% approving of the CEO (Bill Staples), suggests an excellent working experience. Furthermore, GitLab's employee rating aligns well with the average for employers in the Information Technology industry, which stands at 3.9 stars.

Operating Leverage

GitLab’s recent financial results highlight a powerful story of operating leverage and disciplined execution. The company has significantly expanded its non-GAAP operating margin, growing from -2% in Q1 FY25 to 12% in Q1 FY26—a dramatic 14 percentage point improvement year-over-year. This shift reflects GitLab’s ability to grow revenue while keeping expense growth under control, demonstrating the scalability of its business model.

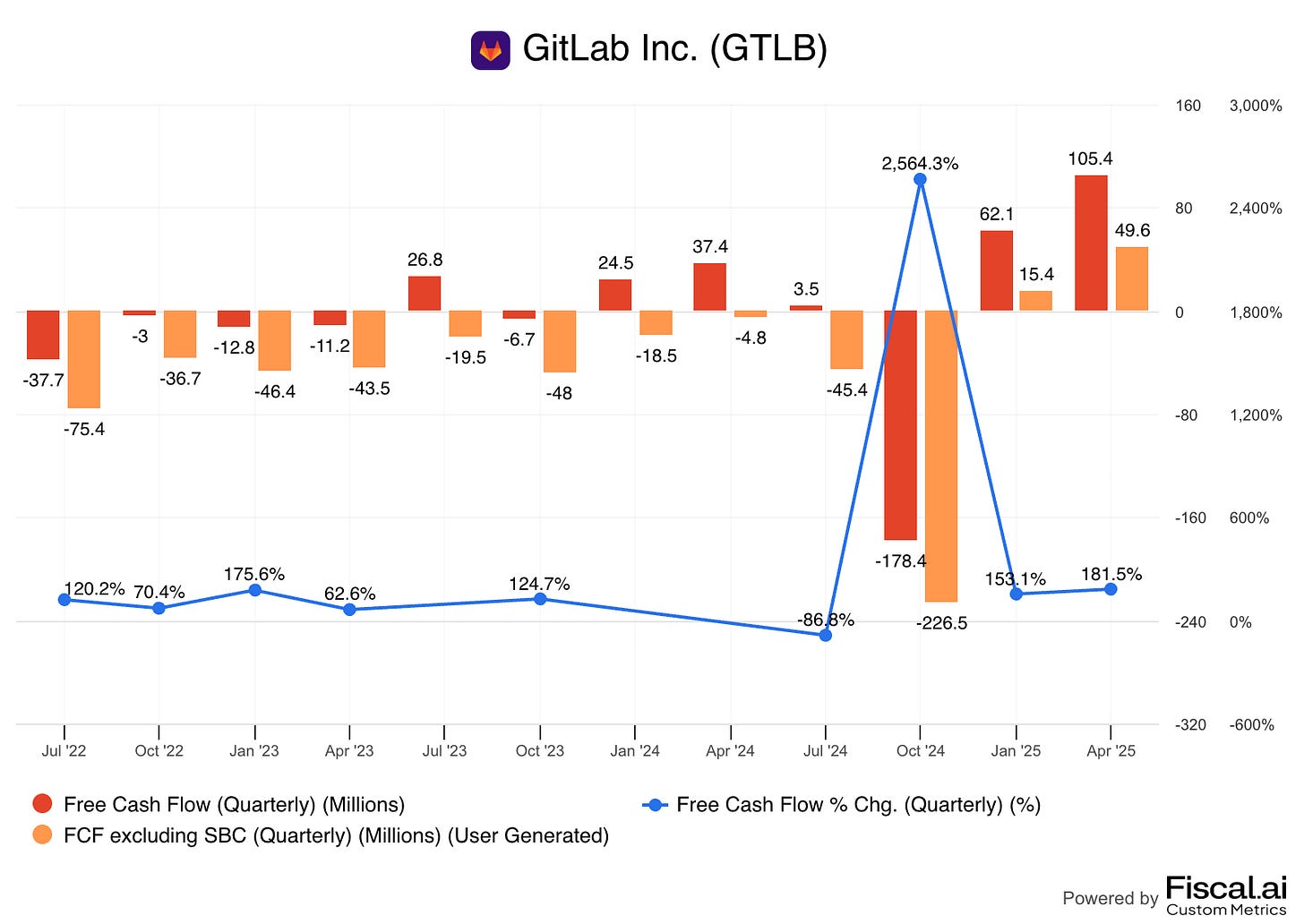

The improvement is not just in margins—adjusted free cash flow surged to $104.1 million in Q1 FY26, nearly tripling from $37.4 million in Q1 FY25. Notably, Q1 FY25 marked GitLab’s first Q1 of positive free cash flow, underscoring the significance of this leap. The company’s CFO emphasized that there were no one-time anomalies driving the result—just seasonality and improved operational efficiency.

Key Drivers of Operating Leverage

Cost Discipline Across Functions

GitLab has shown meaningful reductions in operating expenses as a percentage of revenue:

Sales & Marketing: Dropped from 44% to 40%, indicating improved efficiency in customer acquisition and expansion.

R&D: Marginally declined from 25% to 24%, showing controlled investment in innovation.

G&A: Fell sharply from 24% to 14%, reflecting overhead optimization and leverage from a maturing organization.

GitLab’s expanding margins, strong cash flow, and improving expense ratios showcase a company entering a new phase of financial maturity. The operational leverage it is unlocking not only enhances profitability but also strengthens its ability to invest in future growth areas—such as AI, enterprise expansion, and public sector initiatives—without compromising financial discipline.

Key Financial Metrics

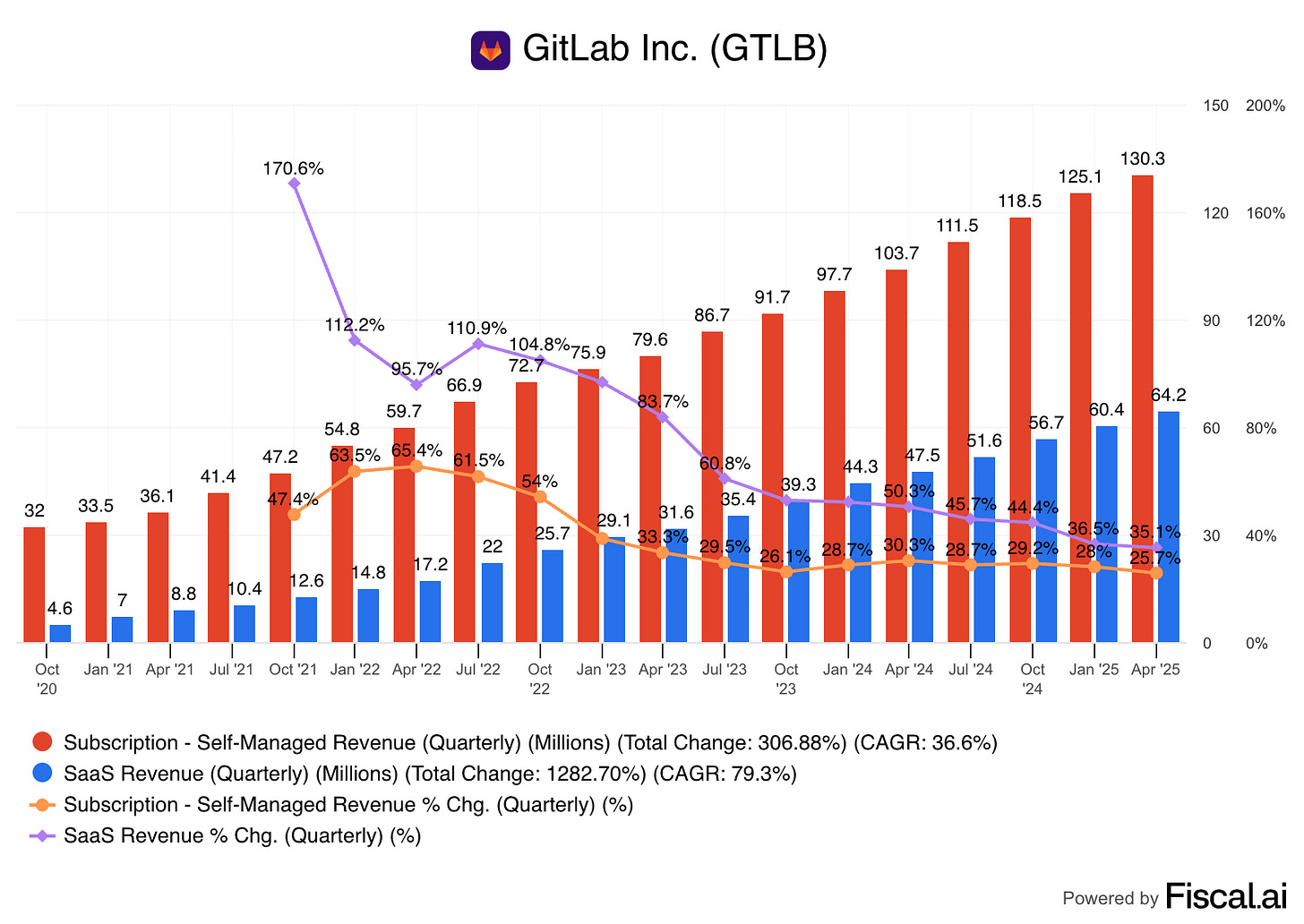

Revenue Mix

Customers are increasingly moving workloads to the cloud and consuming technology as a service. GitLab's SaaS offering provides access to their latest managed product version, hosted either in a public or private cloud based on customer preference. While the percentage change in SaaS Revenue (purple line) shows high volatility, the raw revenue figures clearly indicate a strong and accelerating shift towards SaaS, with its share of total subscription revenue steadily increasing.

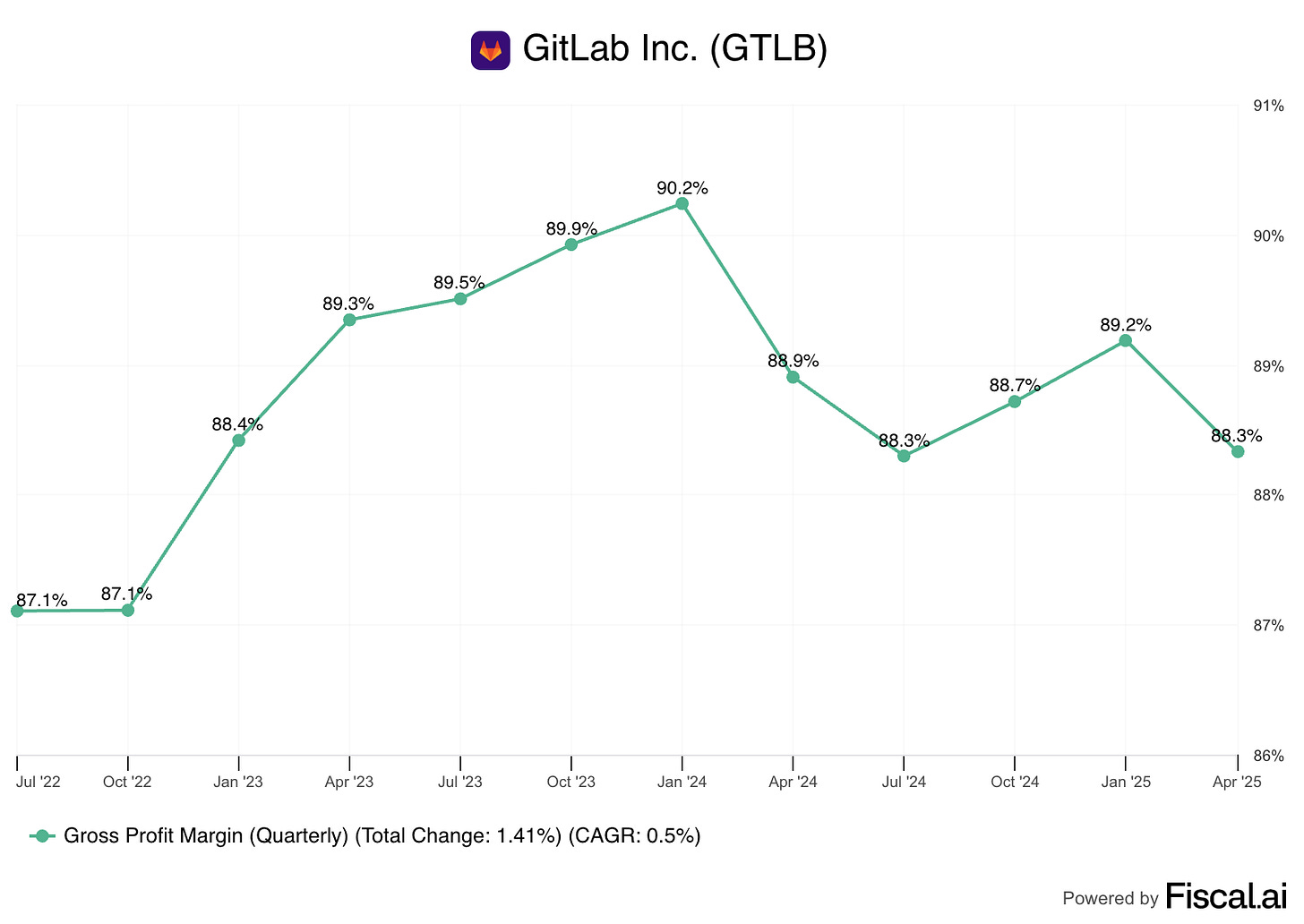

Gross Margin

As the SaaS offering makes up an increasing percentage of total revenue, GitLab expects to see increased associated cloud-related costs, such as hosting and managing costs, which may adversely impact gross margins. However, this is part of their broader strategy for growth and profitability.

A Lumpy Free Cash Flow

GitLab consistently experiences higher cash inflows in Q1 of each fiscal year, directly resulting from the strong sales and renewal orders secured in the preceding Q4. This seasonal pattern is a predictable cause of quarter-over-quarter variability. The most significant impact on GAAP operating cash flow came from the $187.7 million BAPA income tax payment in Q3 FY25. This single event caused GAAP operating cash flow to be negative $177.0 million, while the non-GAAP adjusted free cash flow, which excludes this item, remained a positive $9.7 million. Despite all these, the last two quarters underscores the rapid shift from cash burn to positive cash generation in recent quarters, suggesting improved financial efficiency and operational maturity.

Other Key Performance Indicators

Very strong and consistent growth for customers with ARR > 100K. Dollar based net retention is still holding strong at 122% but has a slight downward trend. RPO % Change is volatile, but maintaining decent growth.

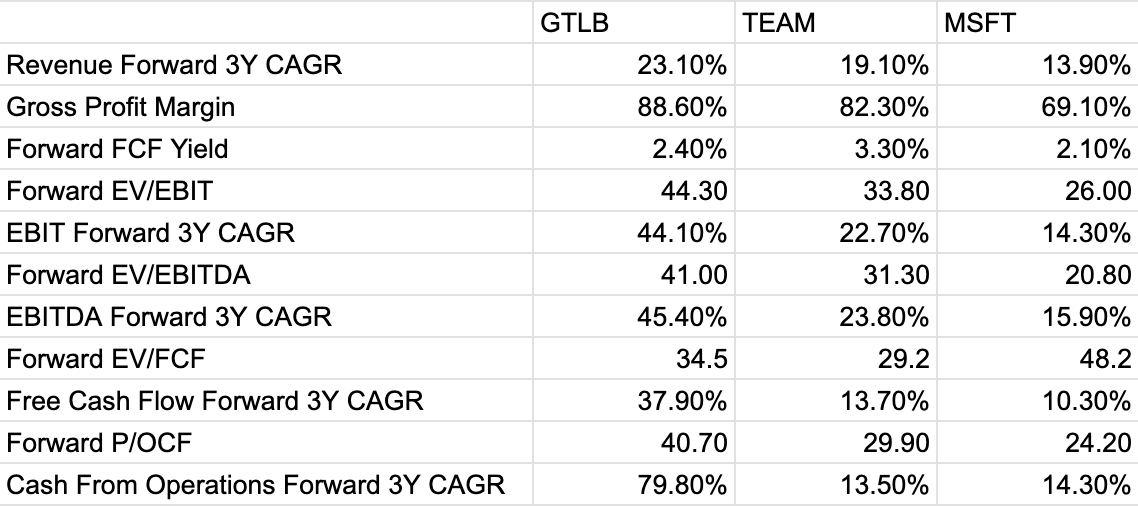

Valuation

I attempt here to compare against other non-pureplay DevSecOps peers. This valuation of GTLB looks very rich alone and in comparison with its peers. However, it looks better, if the growth is factored in. In each of EV/FCF, EV/EBIT and EV/EBITDA categories, valuations are cheaper when normalized with their respective growth.

Valuation Using FCF Multiplier

With GTLB’s high gross margin at 88%+, I think a 25% free cash flow margin is justified. Currently, FY 2030 (Jan 2030) Revenue is estimated to be $1.91B. With ~25% margin $477.5M in free cash flow. A reasonable FCF multiplier of 30 gives us a market cap of over $14B. Gitlab also has a history of diluting its shareholders. In the trailing 3 years, diluted share count has increased by 3.8%. Let’s say the company manages to keep it under 3%. Current 165M share count will grow to 185.7M. Dividing $14B market cap with 185.7M share count gives us a $75 share price. From $42.50 to $75 in 4 years gives us a 15%+ CAGR.

What to Watch For?

Gross margin.

Dollar based net retention holding above 120%.

Customer with > 100K ARR growing.

Conclusion and Recommendation

GitLab Inc. (GTLB) is well-positioned in the fast-growing DevSecOps market, solving the inefficiencies of fragmented toolchains with its unified, AI-native platform. This integrated approach boosts collaboration, security, and innovation—making it a strategic asset for modern enterprises.

The DevSecOps market is projected to grow at over 28% CAGR through 2029. GitLab’s focus on enterprise expansion, public sector adoption (e.g., FedRAMP), and AI-driven features like Duo positions it to capture meaningful market share. Financially, the company is gaining momentum toward sustainable profitability, with rising margins, strong free cash flow, and a Net Retention Rate consistently above 120%. Growing Remaining Performance Obligations further enhance revenue visibility.

While GitLab’s valuation appears rich—particularly when measured against historically lumpy free cash flow—the long-term growth story remains intact. Risks include competition from players like GitHub and ongoing stock-based compensation. However, GitLab’s differentiated product, financial trajectory, and alignment with structural tech trends make it a compelling long-term opportunity.

Actionable Insight: I’m not taking a large position given the valuation and FCF variability, but I’m comfortable initiating or increasing a starter position up to 1% of portfolio weight at current levels.

Love the write up, very in depth! I'm bullish on GTLB myself at these prices