dLocal: The Hyper-Local Fintech Powering Emerging Markets

A deep dive into dLocal’s business model, competitive edge, and why its 83% stock drawdown may be a long-term buying opportunity.

In September 2020, dLocal made history by becoming Uruguay’s first unicorn with a valuation of $1.2 billion – just four years after the startup was founded. dLocal is a cross-border payments processor focused on emerging markets, offering global merchants a single integration to accept a vast array of local payment methods. Its “One dLocal” platform is fully cloud-based and payment-agnostic, connecting enterprises to local acquiring networks across Latin America, Africa, Asia, and the Middle East. dLocal’s platform lets a global merchant make one API call and access local rails (cards, bank transfers, mobile wallets, cash, etc.) in dozens of countries. Its proprietary infrastructure includes AI-driven payment orchestration (smart routing, fallback, redundancy), fraud/KYC engines, and currency conversion. As of latest reports, dLocal enables merchants to tap over 900 payment methods across 40+ countries. This depth of local integration – with direct connections to banks, e-wallets and alternative methods – is central to dLocal’s model. This specialized model enables DLocal to achieve superior authorization rates and manage costs more effectively in the often-fragmented payment landscapes of emerging markets, areas where traditional global players frequently encounter significant challenges.

Despite being a consistently profitable and cash-generative business, dLocal's stock has fallen more than 83% from its all-time high—underscoring the disconnect between strong fundamentals and market perception. To assess whether this sell-off is justified or a long-term opportunity, it’s essential to understand how dLocal operates at its core.

Business Overview

dLocal is an enterprise-focused company catering to large international merchants across a wide array of sectors and geographies, including financial services, remittances, commerce, advertising, streaming, ride-hailing, SaaS, travel, e-learning, gaming, and crypto. Its platform is designed for simplicity, scalability, and agility, accessed via a single API. The company supports over 700 global merchants, with notable clients such as Shein, Didi, Payoneer, Temu, Google, Rappi, Deel, Uber, SpaceX, Worldpay, and Spotify. It also works with marketplaces like Shopify, helping SMB clients and partners expand their geographic reach. The company defines "enterprise merchants" as those processing over US$6 million in total payment volume (TPV) annually. These enterprise clients made up a massive 99% of TPV in 2024, showing consistent dominance, with 98% in 2023 and 97% in 2022. This reflects the platform’s strong and trusted relationships with major global enterprises.

dLocal generates revenue by offering payment processing infrastructure tailored for global merchants operating in emerging markets. Its core business revolves around facilitating pay-ins (consumer payments to merchants) and pay-outs (merchant disbursements to partners or customers), and monetizing these services through multiple fee structures. The company’s model is designed to scale efficiently and profitably by leveraging its specialized capabilities in cross-border and local payment flows.

Payment Processing Fees: The largest portion of dLocal’s revenue comes from transaction fees charged to merchants. These fees apply to both pay-in and pay-out services and are:

Per approved transaction, not attempted ones.

Charged either as a fixed amount per transaction or as a percentage of the transaction value.

Recognized as revenue at the time the transaction is successfully processed.

This model ensures that revenue scales directly with the volume of payments handled on the platform.

Foreign Exchange (FX) Service Fees: Cross-border commerce often involves currency conversion, and dLocal charges merchants an FX service fee in such cases. Key points:

The fee is usually calculated as a percentage of the transaction amount.

It applies when local currencies collected in emerging markets (e.g., BRL, MXN, or KES) are converted and expatriated to merchant-preferred currencies like USD, EUR, or CNY.

This is a critical component of dLocal’s value proposition, especially for global clients seeking seamless currency repatriation from complex markets.

Other Fees: dLocal also earns revenue through a variety of ancillary fees, which include:

Installment-related fees (e.g., for transactions split across multiple payments)

Chargeback and refund processing fees

One-time setup charges

Monthly minimum usage or platform fees

Maintenance and small fund transfer fees

While these are smaller in scale compared to transaction and FX fees, they contribute to overall revenue stability.

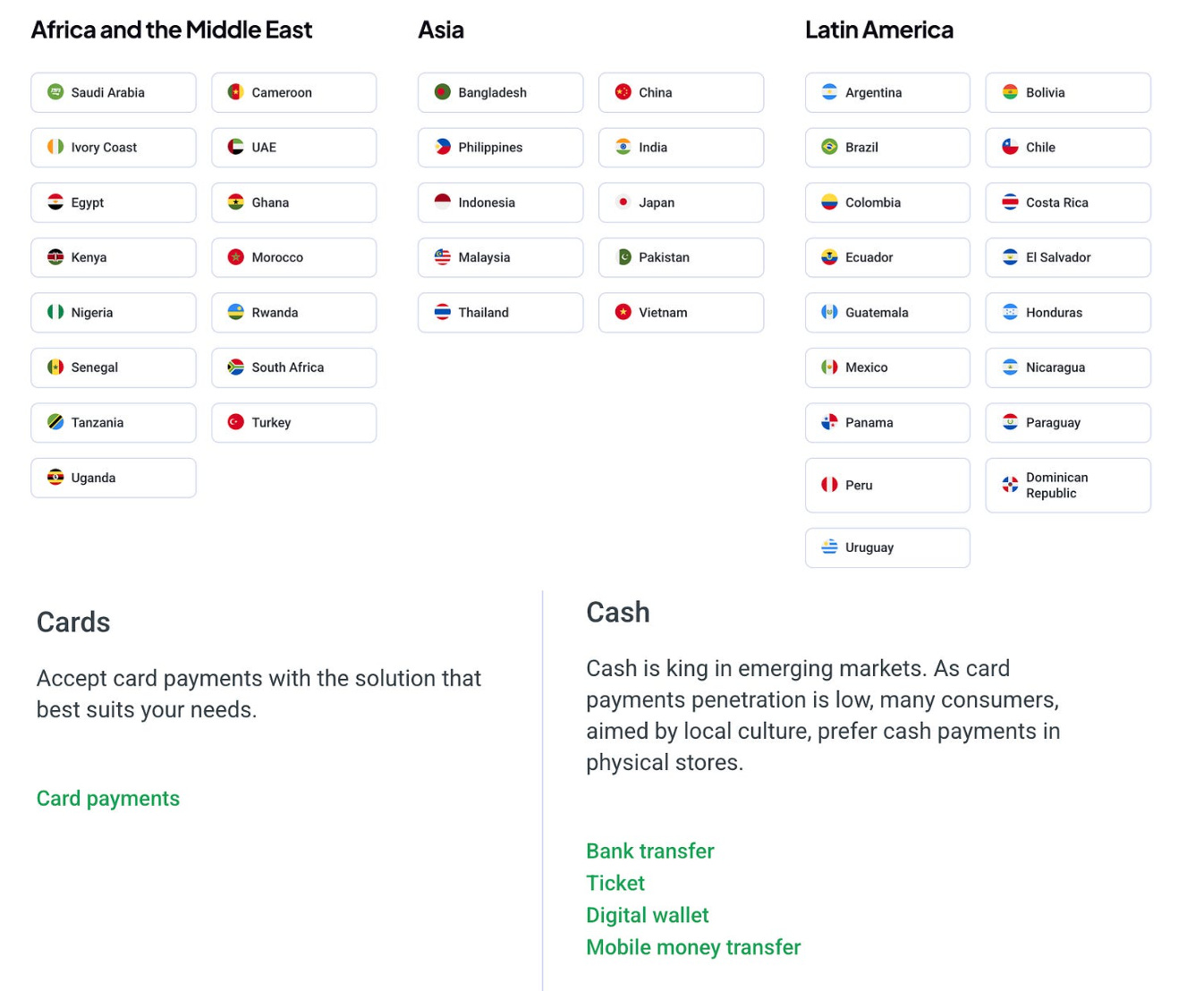

Coverage

Business Model & Merchant Economics

dLocal operates an asset-light model, focusing on scalability and margin optimization:

It connects enterprise merchants (like Google, Amazon, Shein, Spotify) to consumers in 40+ emerging markets across Latin America, Africa, and Asia.

In 2024, a significant portion of dLocal’s revenue came from existing clients, reflecting a net revenue retention (NRR) of 113%, which indicates upsell and growth within the current merchant base.

The revenue contribution from certain merchants may grow at a slower pace over time due to tiered pricing contracts, where higher volumes may be charged at lower rates.

This model allows dLocal to maintain strong profitability and free cash flow, reinvest in product development, and further expand into under-penetrated markets.

Emerging Market Opportunity

Emerging markets are fast-growing economies in transition, marked by increasing industrialization, rising GDP, and expanding consumer bases. While they may not yet meet the criteria of fully developed economies, countries like Brazil, Russia, India, and China (the BRIC nations) exemplify their growing global economic influence. The broader category also includes many nations across Africa, Latin America, Southeast Asia, Eastern Europe, and the Middle East.

These markets are typically characterized by lower income levels, high growth rates, and efforts toward market liberalization. Many are undergoing institutional reforms and integrating more deeply into the global economy. A growing middle class and expanding digital access make them attractive targets for global commerce, even as infrastructure and regulatory frameworks continue to evolve.

The diversity of these regions means that one-size-fits-all strategies don’t work. Payment methods, consumer behaviors, and regulatory environments vary widely. For instance, while mobile wallets dominate in China, cash remains king in many African economies. Success in these markets requires localized approaches that adapt to specific needs, infrastructure realities, and legal systems—underscoring why global payment providers must offer flexible, tailored solutions.

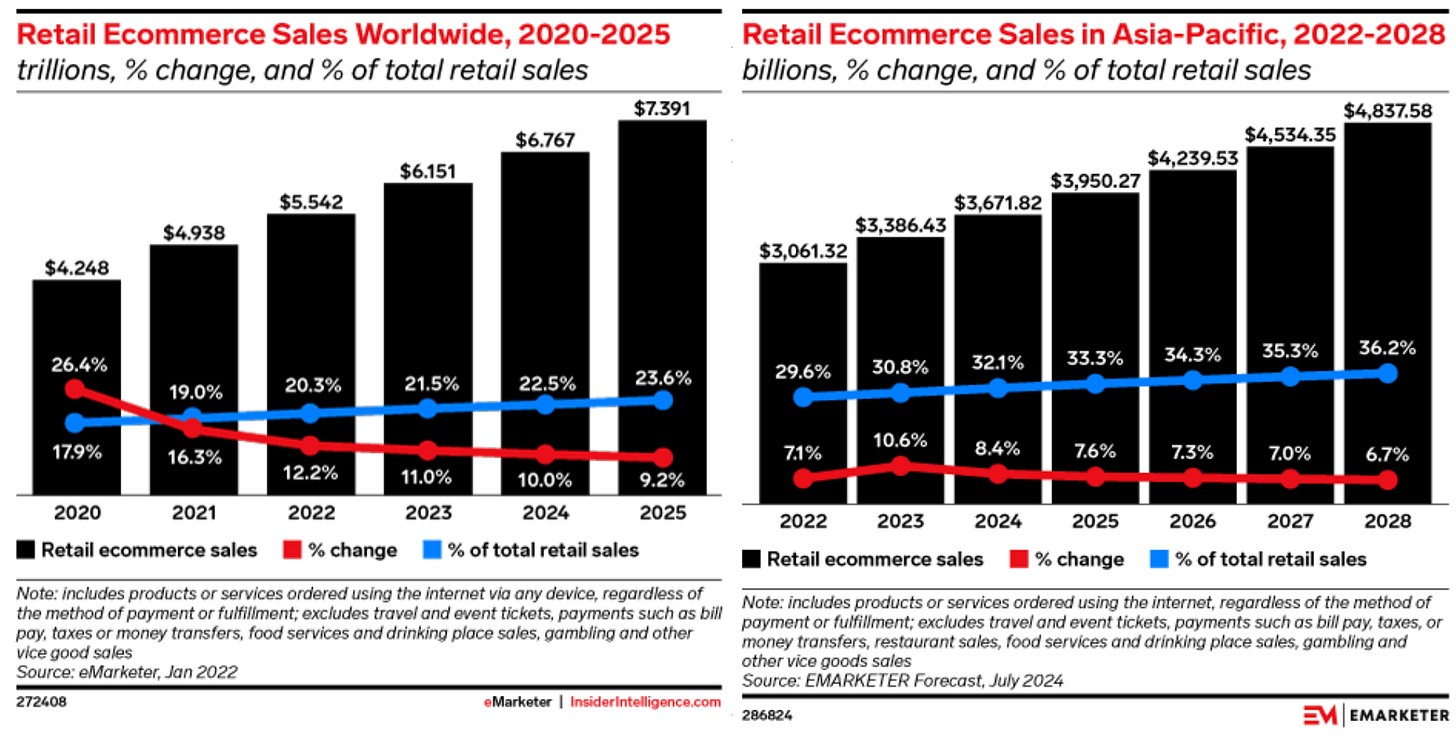

Global E-commerce Trends in Emerging Markets

Global retail e-commerce sales are projected to reach $7.4 trillion by 2025, accounting for 24% of all retail transactions [eMarketer]. Emerging markets are leading this growth, with Turkey expected to be the fastest-growing e-commerce market globally, showing an 11.58% CAGR through 2029 [Statista]. Brazil closely follows at 11.56%.

In the Asia-Pacific region, which includes several major emerging markets, over 53% of global e-commerce revenue is expected to be generated by 2025. However, for 52% of global e-commerce businesses, localizing payments remains a top challenge [Verifone]. These trends highlight the growing importance of emerging markets and the need for payment providers that can offer region-specific solutions.

Barriers to Digital Payments in Emerging Markets

Despite high growth potential, emerging markets present distinct challenges. Many regions suffer from limited banking infrastructure, unreliable internet access, and underdeveloped digital payment networks. These issues make it difficult to expand e-commerce without localized infrastructure and support.

Cash Dominance

Cash remains a dominant payment method across many emerging markets, driven by cultural habits, distrust in digital systems, and limited access to formal financial services. This creates barriers to digital commerce, particularly for unbanked populations.

To bridge the gap, payment processors must enable “offline-to-online” solutions that convert cash into digital transactions. Tools like Brazil’s Boleto Bancario and cash-on-delivery models in Africa demonstrate how cash can still be used to complete online purchases. Building this functionality requires robust local networks and regulatory familiarity—critical to capturing a broader share of e-commerce users.

Localized Payment Methods and Solutions

A core challenge in emerging markets is the limited use of international credit cards—often below 20%, and as low as 3% in Nigeria [nasdaq]. Alternative Payment Methods (APMs) dominate, including mobile money (e.g., M-Pesa in Kenya, GCash in the Philippines), digital wallets (e.g., Alipay, WeChat Pay), and super apps like Gojek and Grab that integrate payments with daily services. Other popular methods include local bank transfers, cash vouchers (e.g., OXXO in Mexico), and Buy Now, Pay Later options.

Consumers strongly prefer familiar payment methods: 99% of cross-border shoppers expect to use local options. With mobile phones often serving as the primary digital access point in these markets, payment platforms must prioritize mobile-first design and functionality [pymnts].

Government Policies and Regulatory Evolution

Governments in emerging markets are actively encouraging digital commerce through infrastructure investment and supportive policy reforms. Many are also promoting financial inclusion by enabling mobile-led financial services, allowing populations to bypass traditional banking systems altogether.

This rapid mobile adoption creates opportunities for fintechs to provide foundational financial infrastructure—not just for payments, but for services like digital wallets, lending, and card issuance. In doing so, these providers are helping shape the financial future of economies where banks alone cannot fill the gap. Payment companies that build local trust and compliance expertise are well-positioned to become essential partners in the digital growth of these markets.

dLocal’s Growth Potential

Digital commerce is accelerating across Latin America, Africa, and Southeast Asia, where traditional banking infrastructure is limited, and mobile penetration is high. As more consumers shift from cash to digital wallets, bank transfers, and APMs, dLocal is well-positioned as a payment bridge between global merchants and these hard-to-access users.

dLocal continues to enter new markets. In 2025, it secured licenses in the UK, UAE, Turkey, and the Philippines, and announced the acquisition of AZA Finance to deepen its African presence. These moves unlock new corridors for both pay-ins and pay-outs, increasing total addressable volume.

Competition and dLocal’s Edge

The rapid growth of e-commerce in emerging markets presents significant opportunities for payment processors. dLocal, Adyen, and Stripe, each with distinct strategic approaches, are uniquely positioned to benefit from and contribute to this expansion.

dLocal: The Hyper-Local Specialist

dLocal's core mission is to bridge the "payments innovation gap" between developed economies and emerging markets. The company acts as a vital intermediary, connecting global merchants with consumers in these regions. Its unique value proposition lies in its 360-degree payment solution: a single technology platform designed to manage and facilitate online payments across numerous emerging markets. This eliminates the operational complexities for businesses, removing the need to juggle multiple local entities, separate pay-in and payout processors, and integrate numerous acquirers in each market.

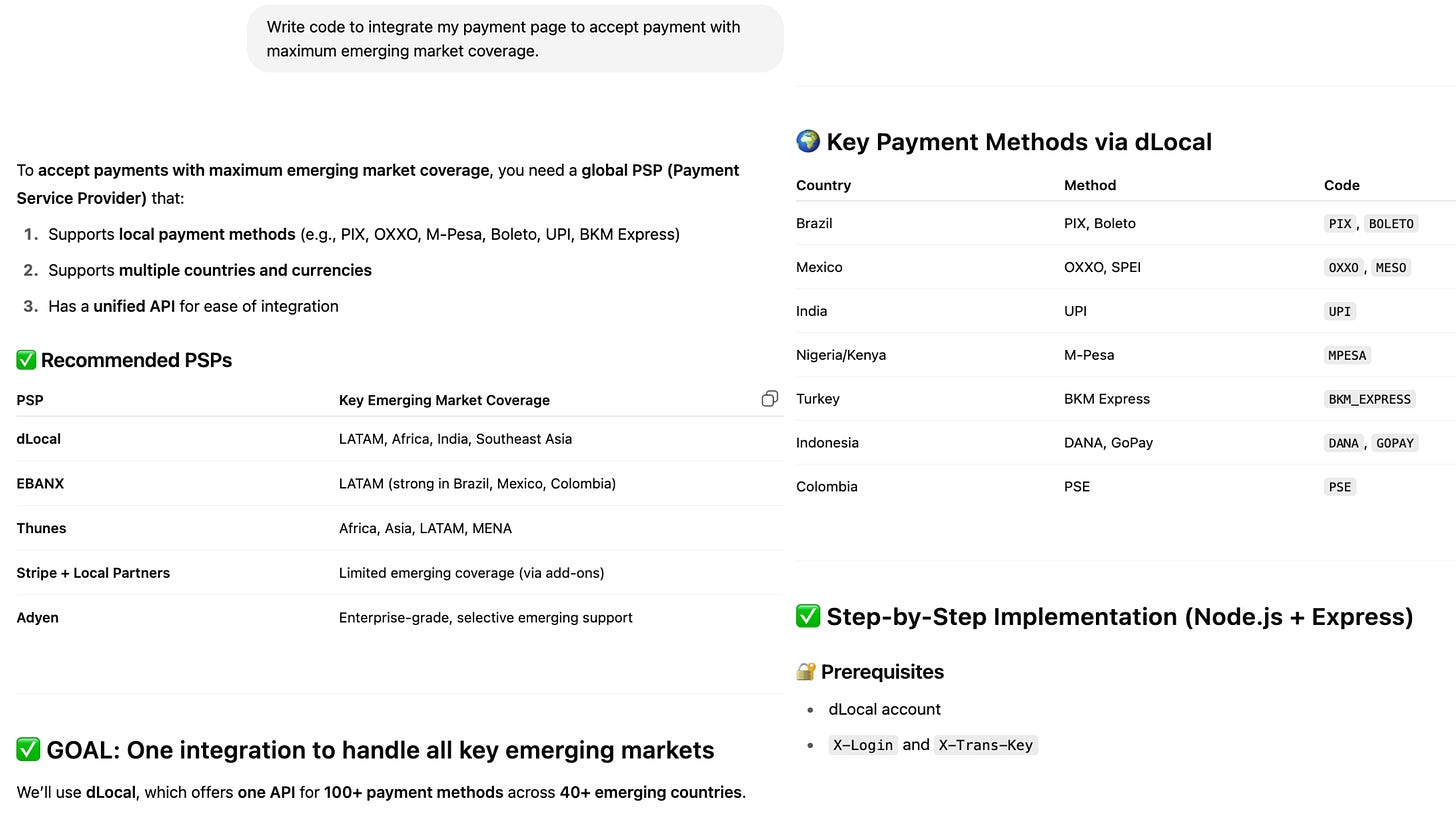

dLocal's strategic focus is heavily skewed towards APMs and simplifying cross-border transactions. Recognizing that less than 20% of consumers in emerging markets have access to international credit cards , dLocal prioritizes supporting the locally popular APMs. Their extensive network includes over 900 local and APMs, such as local credit cards, cash payments (e.g., OXXO in Mexico, Boleto Bancario in Brazil), bank transfers, and eWallets. Furthermore, dLocal streamlines the intricate legal, tax, and regulatory complexities across over 40 markets spanning Latin America, Africa, and Southeast Asia, offering a simplified solution through a single, sophisticated API.

dLocal's deep specialization in hyper-localization and its extensive acquisition of local licenses represent a significant strategic advantage against global competitors. The consistent emphasis on a vast array of local payment methods and the procurement of numerous country-specific licenses (over 30 globally) are direct, deliberate responses to the fragmented and complex nature of emerging markets. While larger, more generalized payment providers may offer broad global coverage, dLocal's granular, country-by-country expertise in regulatory compliance and payment methods allows it to effectively capture market segments that demand highly tailored solutions. This is particularly crucial in regions where traditional credit card penetration is low and cash remains a dominant payment method. This specialized approach positions dLocal as a critical enabler for global merchants seeking genuine market penetration, rather than just superficial payment acceptance.

How dLocal Differs with Adyen and Stripe

Compared to global players like Adyen and Stripe, dLocal takes a distinctly hyper-local approach, deeply embedding itself in the fragmented ecosystems of emerging markets. Adyen operates a fully integrated, end-to-end payments platform built on its own proprietary tech stack, with direct acquiring and banking licenses in multiple regions. This model gives Adyen complete control over the payment flow, enabling it to offer high authorization rates, lower transaction costs, and real-time insights for large multinational enterprises operating across both developed and emerging markets. Adyen’s strength lies in delivering a consistent, high-performance global payment experience for enterprise clients who value control, efficiency, and scalability.

Stripe, on the other hand, is a developer-first platform optimized for startups, digital platforms, and marketplaces. Its modular, API-driven infrastructure allows businesses to easily build and scale payment solutions, with support for over 135 currencies, 100+ payment methods, and advanced tools for fraud prevention, tax automation, and card issuing. Stripe is particularly strong in serving tech-native businesses and enabling rapid deployment in global markets, often through partnerships with local acquirers rather than obtaining licenses directly.

In contrast, dLocal’s model is purpose-built for complexity—targeting emerging markets where financial infrastructure is underdeveloped, regulatory environments are opaque, and cash and local payment methods still dominate. Rather than aiming for global uniformity, dLocal embraces local diversity, obtaining over 30 country-specific licenses and integrating more than 900 local payment methods. This makes it a critical partner for global merchants looking for deep, compliant, and frictionless market penetration in hard-to-access regions where Stripe and Adyen may not have sufficient infrastructure or local presence.

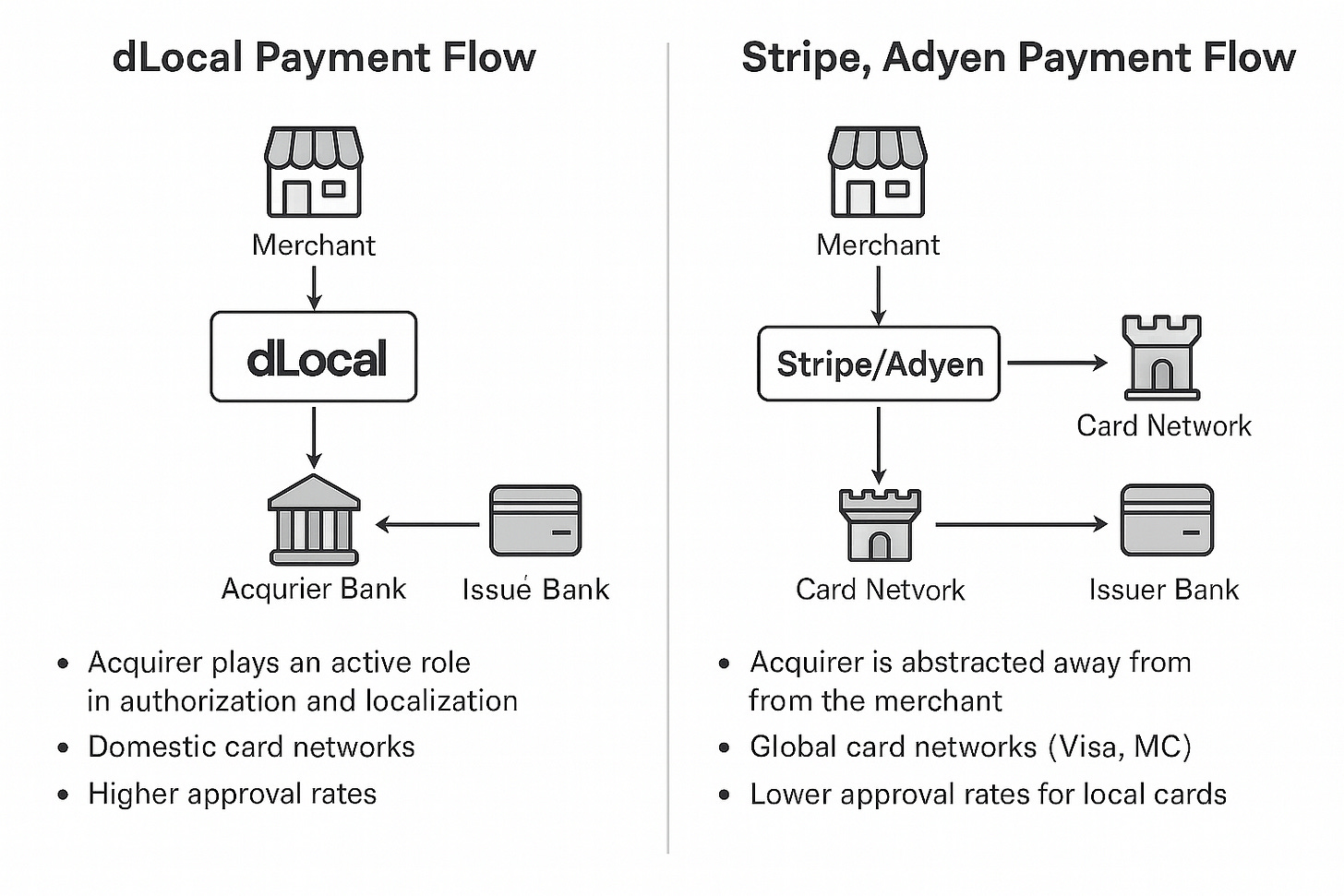

Payment Flow Comparison

In the dLocal payment flow, a merchant in a developed country sells to a customer in an emerging market using local payment methods. When the customer initiates a transaction (e.g., with a local debit card or Pix), dLocal processes it via a domestic acquiring bank connected to local card networks or banking infrastructure. The acquirer plays an active role in the transaction, handling authorization, compliance, and settlement. By operating locally, dLocal improves authorization rates, supports domestic-only cards, and handles currency conversion before globally settling the net amount (e.g., in USD) to the merchant. This “local-first” approach is optimized for fragmented markets with regulatory, infrastructure, or currency barriers.

In contrast, the Stripe or Adyen payment flow follows a more standardized, global model. When a customer pays, Stripe or Adyen routes the transaction through international card networks like Visa or Mastercard, bypassing local acquirers unless required. The card network forwards the request to the customer’s issuing bank, which approves or declines the transaction. The acquirer is often abstracted away, bundled into Stripe or Adyen’s infrastructure. While this setup works well in developed markets, it can lead to lower approval rates in emerging markets due to lack of local integration and support for domestic payment schemes. Stripe and Adyen prioritize scalability and developer-friendly APIs, while dLocal is built for localization and compliance in complex payment environments.

Fierce Competition with Other Local Payment Processors

Among dLocal’s closest competitors, EBANX stands out as its most direct rival, particularly in Latin America. Both companies enable global merchants to accept local payment methods in emerging markets, but while dLocal offers a more balanced platform with both pay-in and pay-out capabilities across 40+ countries, EBANX is primarily focused on checkout and consumer pay-ins in Latin America. EBANX has built strong relationships with merchants like AliExpress and Spotify and continues to expand into markets like Africa and India, signaling broader ambitions. However, dLocal’s strength lies in its deeper regulatory footprint, FX infrastructure, and enterprise focus, giving it an edge in complex multi-directional payment flows. By contrast, platforms like Payoneer target SMBs and freelancers globally, and Network International operates as a traditional merchant acquirer with a stronghold in the Middle East and Africa—both serving different customer profiles and payment needs than dLocal and EBANX.

Edge of “One dLocal” Platform

When testing emerging market payment coverage through a simulated integration request, dLocal’s platform stood out for its breadth and simplicity—reinforcing its claim as the most developer-ready solution for localized payments at scale.

Strategic Partnerships

dLocal powers payments for a wide range of global leaders by solving complex challenges in emerging markets through localized pay-in and pay-out infrastructure.

Temu partnered with dLocal in March 2025 to support its rapid expansion across 14 emerging markets in Africa, Asia, and Latin America. By integrating local payment rails and FX capabilities, dLocal enables Temu to scale efficiently in regions with diverse regulatory and consumer payment landscapes.

Amazon began working with dLocal in 2021 to allow international sellers on Amazon Brazil to accept local payments and receive USD payouts. This unlocked cross-border commerce in Brazil by addressing its complex currency and compliance barriers.

Rappi, Latin America’s leading super-app, uses dLocal to accept local payments like PIX and domestic cards while also managing payouts to restaurants, couriers, and cardholders—supporting its fintech and logistics ecosystem across nine countries.

Zepz relies on dLocal to enhance remittance delivery in underbanked regions. Their partnership spans Latin America, Africa, and Asia, with recent expansion into additional African markets, leveraging dLocal’s infrastructure for fast, compliant cross-border transfers.

Hotmart expanded its creator payment operations through dLocal, enabling digital content transactions across Brazil, Mexico, Ecuador, and beyond. dLocal provides Hotmart with tailored local payment methods and payout solutions to match regional preferences.

Deel uses dLocal to pay remote workers and contractors in over 40 countries through 300+ local methods. This streamlines global payroll logistics and ensures compliance in highly fragmented financial environments.

Uber and DiDi depend on dLocal for secure, real-time payouts to drivers and partners in Latin America. dLocal’s ability to manage scale, speed, and regulatory complexity supports the core operations of these gig platforms.

UK Expansion: In January 2025, dLocal secured a UK FCA license, enabling it to onboard British merchants through AstroPay and support their entry into emerging markets with compliant payment flows.

New Licenses: In June 2025, dLocal added key licenses in the UAE, Turkey, and the Philippines—bolstering its ability to operate locally and reducing reliance on third parties in strategically important corridors.

dLocal and BVNK: Enabling Crypto-to-Fiat Payments: dLocal partnered with BVNK to support crypto-to-fiat and fiat-to-crypto transactions in emerging markets. The collaboration enhances dLocal’s settlement capabilities, offering faster, cost-effective cross-border payments by bridging blockchain rails with local currencies—further expanding its payment flexibility for global merchants.

dLocal to Acquire AZA Finance: On February 29, 2024, dLocal announced its agreement to acquire AZA Finance, a cross-border payments and FX platform with strong operations in markets like Nigeria, Kenya, and South Africa. The deal boosts dLocal’s regulatory presence, infrastructure, and FX capabilities across Africa, accelerating its growth in the region’s digital economy.

Other Notable Clients span SaaS (GoDaddy, MailChimp, Dropbox), streaming (Netflix, Spotify), travel (Booking.com, TripAdvisor), retail (Nike, Zara, Shopify), gaming (Eneba), and even nonprofits (Wikimedia). This broad adoption highlights dLocal’s versatility and its role as a critical enabler of global digital commerce in emerging economies.

Management

Sebastián Kanovich is the founder and former CEO of dLocal. Under his leadership, dLocal became Uruguay’s first unicorn and one of Latin America's most successful fintechs, culminating in a 2021 IPO on Nasdaq—one of the largest for a Latin American tech company. Today, he continues to serve on dLocal’s Board of Directors, focusing on long-term strategy, innovation, and helping guide the company’s mission to simplify global commerce in emerging economies.

Pedro Arnt’s appointment as CEO of dLocal in September 2023 was met with considerable excitement across both the fintech and investor communities—marking a pivotal moment in the company’s evolution from a high-growth startup to a global payments infrastructure leader. Arnt brought instant credibility. As the longtime CFO of Mercado Libre, he was widely regarded as one of Latin America’s most accomplished tech executives, having helped scale one of the region’s most valuable companies through its most transformative years. His move to dLocal signaled not just a change in leadership, but a doubling down on discipline, scale, and institutional-grade governance.

Nearly 49% of dLocal is owned by insiders, signaling strong founder alignment and long-term commitment. However, employee reviews on Glassdoor paint a more nuanced picture, with a moderate 3.7 rating reflecting a mixed workplace experience. While many value the fast-paced environment and global exposure, concerns around long hours, limited career progression, and below-average compensation are common. The company is often viewed as a strong platform for early-career growth in fintech, though retention and internal structure remain areas for improvement.

Revenue Quality

dLocal’s revenue quality is characterized by high dependence on macroeconomic cycles and a high share of recurring transaction-based revenue. As a cross-border payments provider serving global enterprise merchants in emerging markets, its revenue is very sensitive to FX volatility, inflation, and shifts in consumer demand—particularly in countries like Argentina or Nigeria—making it a highly macroeconomic sensitive company. However, its business model is built on ongoing transaction volume from large, sticky clients like Amazon, Spotify, and Temu, leading to a strong base of recurring revenue tied to payment flows rather than one-off contracts. With a Net Revenue Retention rate of 113% in 2024, dLocal demonstrates consistent upsell and expansion within existing accounts— making their revenue highly recurring.

Q1’25 Financial Highlight

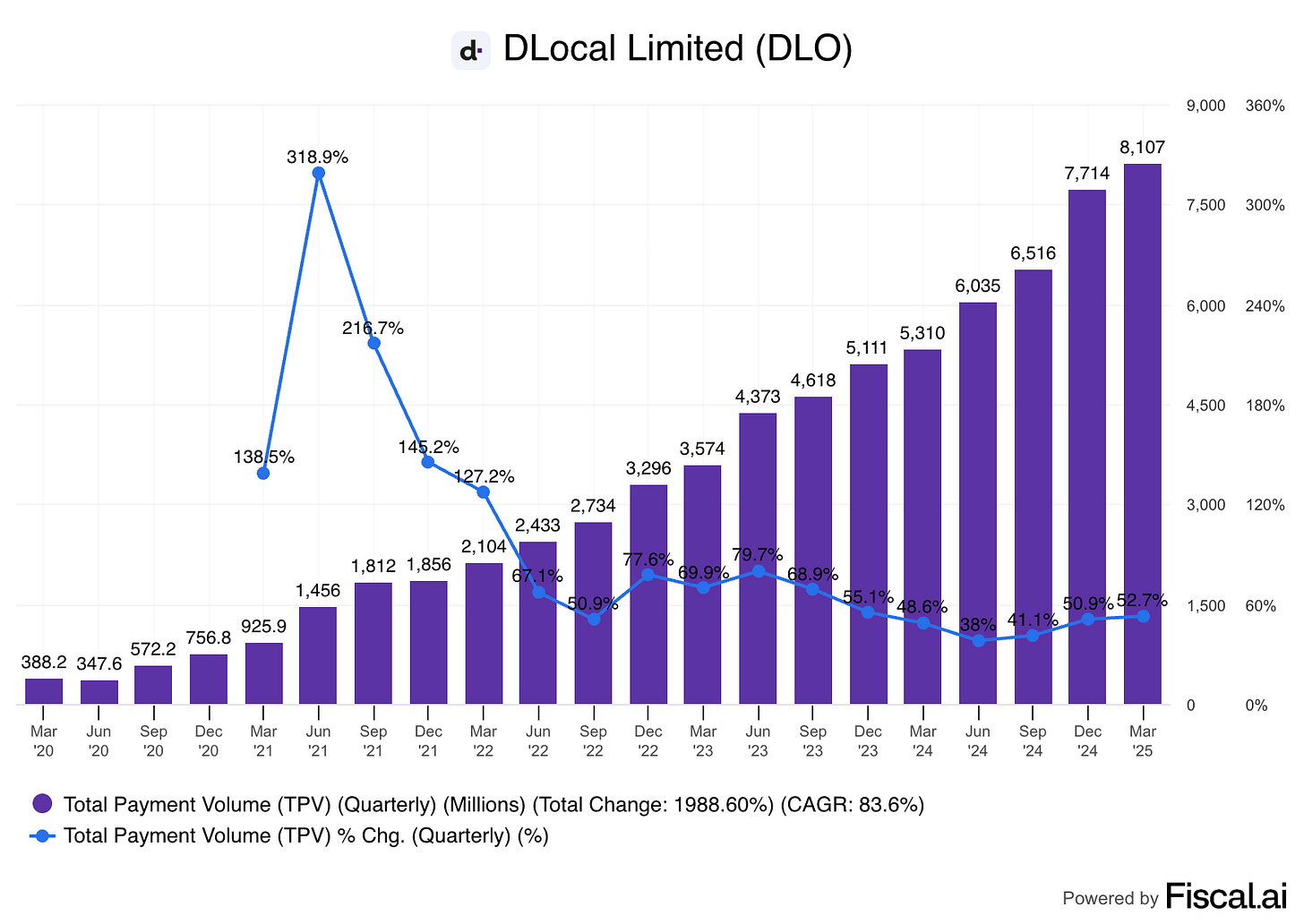

TPV reached a record US$8.1 billion, up 53% year-over-year compared to US$5.3 billion in the first quarter of 2024 and up 5% compared to US$7.7 billion in the fourth quarter of 2024. In constant currency, TPV growth for the period would have been 72% year-over-year.

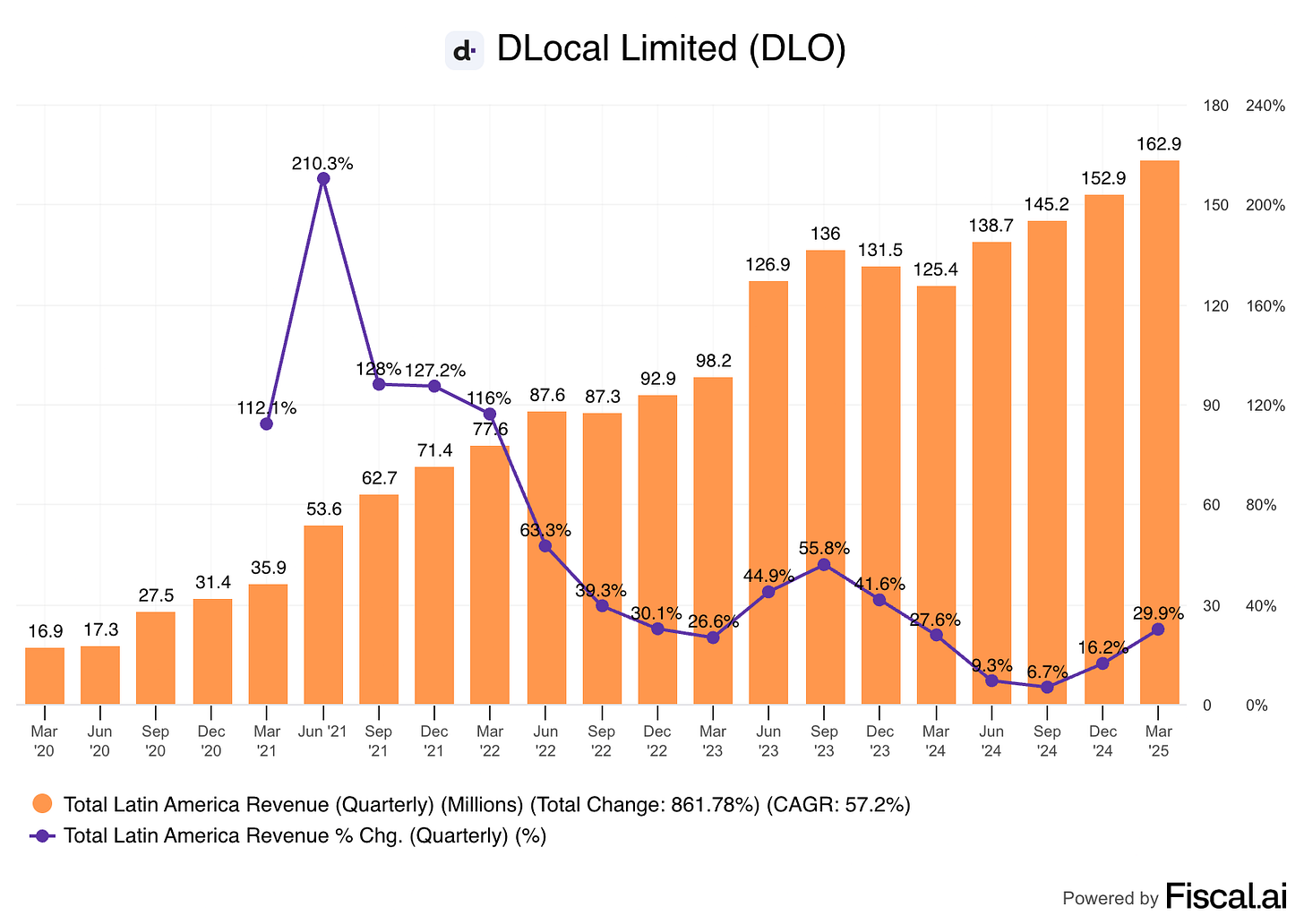

Total revenue grew 17.5% YoY. Latin America accounted for 75% of total revenue and expanded at a strong 29.9% YoY, driven primarily by performance in Argentina. However, despite the majority contribution from LatAm, revenue from Africa and Asia declined by 9% YoY.

Operating profit was US$45.8 million, up 70% compared to US$26.9 million in the first quarter of 2024 and up 8% compared to US$42.3 million in the fourth quarter of 2024.

Adjusted EBITDA was US$57.9 million, up 57% compared to US$36.8 million in the first quarter of 2024 .

Risks

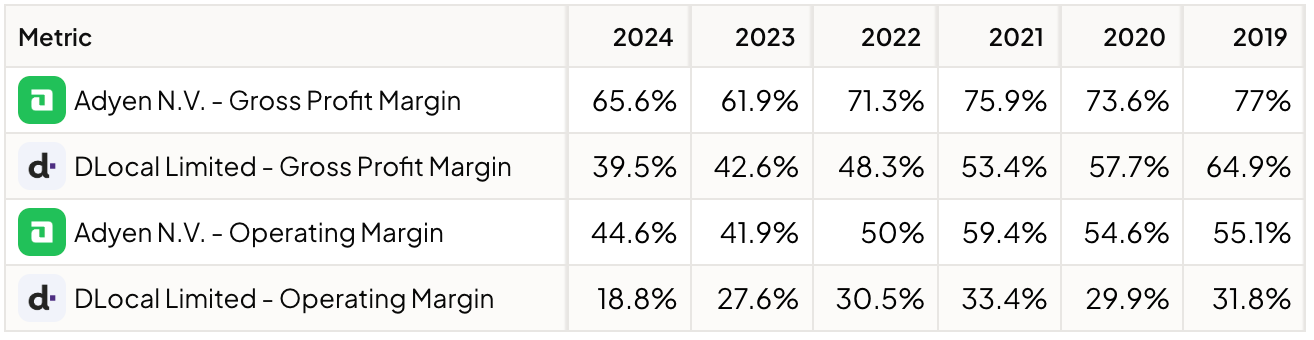

dLocal’s take rate of 1.05% is significantly higher than Adyen’s 0.162%, reflecting the vastly different markets they operate in. While Adyen processes high volumes for global enterprise merchants in developed markets with commoditized infrastructure, dLocal specializes in complex, high-friction emerging markets, where it bundles payment acceptance with services like local regulatory compliance, FX conversion, pay-outs, and integration with APMs. This value-add allows dLocal to charge more per transaction, but it doesn’t translate into superior profitability.

Despite its higher take rate, dLocal’s gross profit margin has deteriorated from 64.9% in 2019 to 39.5% in 2024, while Adyen still posts a robust 65.6% gross margin. The gap is due to dLocal’s higher cost base, which includes local banking partnerships, volatile FX spreads, and the need for country-specific infrastructure and licenses. As dLocal expands aggressively—securing licenses in the UK, UAE, Turkey, and acquiring AZA Finance in Africa—its upfront investment and operational complexity weigh heavily on margins. This is also evident in its operating margin, which has fallen to 18.8% in 2024, compared to Adyen’s 44.6%. Investors have taken notice: bulls argue that these investments are building long-term defensibility, while skeptics worry that unit economics are weakening, and dLocal may face pressure on pricing as global or local competitors scale into its core markets.

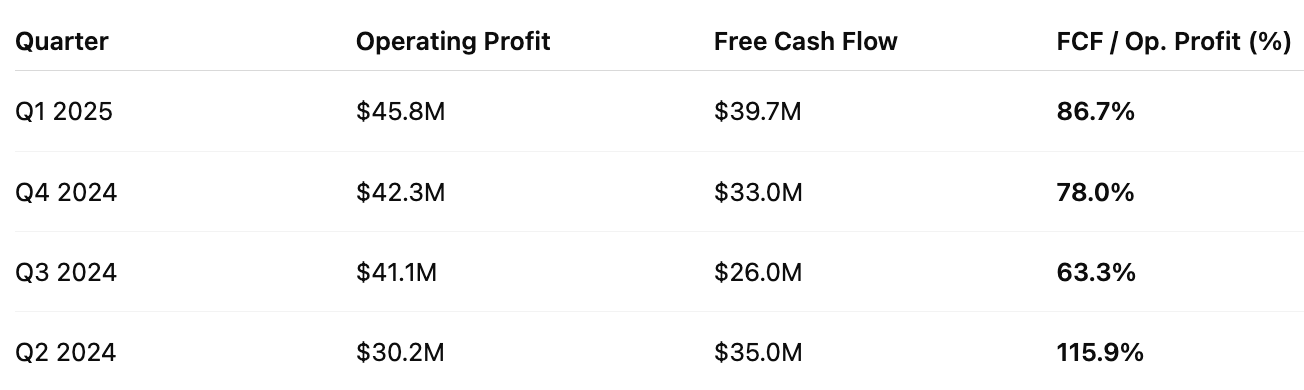

Valuation

Over the past four quarters, dLocal has demonstrated strong free cash flow (FCF) conversion, with FCF averaging approximately 86% of operating profit. While individual quarters have shown some variability—driven largely by working capital swings, tax payments, and occasional one-off items like FX-related adjustments—the business consistently converts the majority of its operating income into cash. This strong cash generation reinforces dLocal’s identity as a capital-efficient fintech, even as it faces margin pressures and incurs upfront costs related to market expansion and regulatory licensing in new regions.

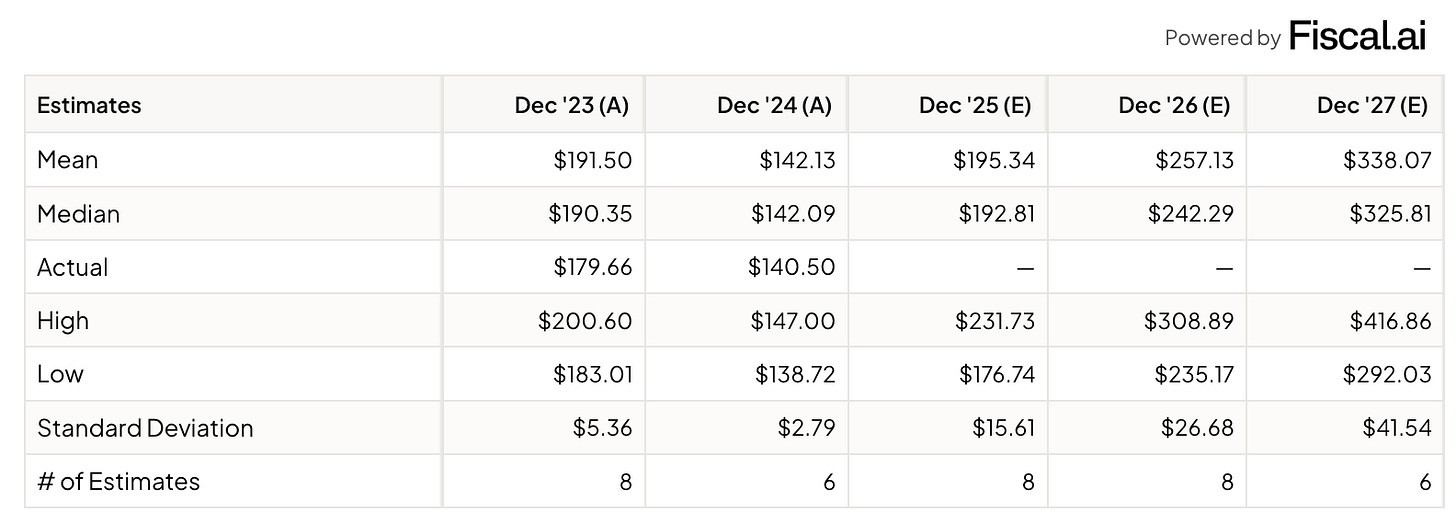

Looking ahead, dLocal is expected to generate approximately $195 million in EBIT in 2025, based on analyst consensus. Assuming it maintains its historical FCF conversion rate of 85%, that would translate to around $165 million in FCF. With a market capitalization of $3.27 billion as of July 3, 2025, the company trades at roughly 16.8x estimated 2025 EBIT and 19.5x estimated 2025 FCF. While not deeply discounted, this valuation is within reason for a company with dLocal’s growth profile and structural positioning in the global payments space. Notably, the stock was more attractively priced following the Q1 2025 earnings, before a subsequent rally.

Projecting further out, if dLocal reaches a 2027 median EBIT of $325 million, and continues converting 85% to FCF, it could generate around $276 million in FCF. At a consistent 20x FCF multiple, this implies a future market cap of approximately $5.5 billion. Factoring in the company’s ongoing share repurchase activity, including the 2024 buyback program under which it has already repurchased over 11.5 million shares for $101 million (as of March 31, 2025), the share count could decline modestly. Assuming a 1.1% cumulative reduction and modest dilution reversal, the 2027 share price could approach $19, translating to a compound annual growth rate (CAGR) of over 29% from current levels.

In terms of capital returns, dLocal has been active with buybacks. The first repurchase program, launched in December 2022 for $100 million, was fully utilized by mid-2023. A second program, approved in May 2024 for up to $200 million, remains ongoing. These repurchases reflect management’s confidence in the company’s long-term value and its ability to return capital while still investing in growth.

Conclusion

dLocal’s 86% decline from its all-time high reflects a sharp reversal in sentiment—but not necessarily in fundamentals. Beneath the volatility lies a business with real competitive advantages: a hyper-local model purpose-built for the complexity of emerging markets, strong relationships with global merchants, and consistent free cash flow generation—averaging 86% of operating profit over the past year. While margin pressure, regulatory risks, and execution in new markets remain real concerns, the market appears to be pricing in an overly pessimistic scenario.

With disciplined capital allocation, expanding geographic licenses, and a credible new CEO in Pedro Arnt, dLocal is entering a new phase. If the company can maintain its growth trajectory and improve margin discipline, it doesn’t need to return to past highs to generate strong shareholder returns. At today’s valuation, even partial re-rating or earnings expansion could drive meaningful upside—offering a potentially asymmetric setup for investors willing to stomach near-term volatility in pursuit of long-term compounding.

any thoughts on the growth potential for DLO? this company seems like a hidden gem as compared to paypal or stripe at the moment